Verizon Wireless, T-Mobile, AT&T, SK Telecom, Deutsche Telekom, NTT Docomo, Orange, SoftBank, among others, are gearing up for 5G networks this year.

Verizon Wireless, T-Mobile, AT&T, SK Telecom, Deutsche Telekom, NTT Docomo, Orange, SoftBank, among others, are gearing up for 5G networks this year.

The ambition to enhance business efficiency from network is motivating global operators in making investment in 5G. The current 5G use cases are fixed wireless broadband and mobile 5G, and IoT will not be a strong use case till 2020, says analyst firm TBR.

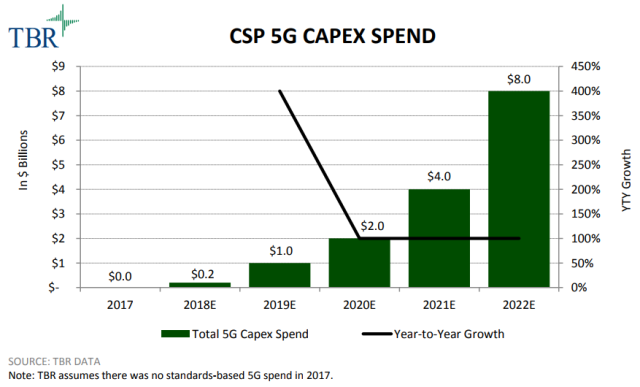

According to TBR’s 1Q18 5G Telecom Market Landscape, most early adopter operators will justify 5G investment for its efficiencies; significant CSP 5G revenue generation will occur in the early 2020s.

The investment plan announced by top operators does not indicate a strong increase in their Capex (capital expenditure) in 2018. Both Nokia and Ericsson are not expecting any Capex growth from mobile service providers towards 5G in 2018 and 2019.

“Operators will initially leverage 5G for traditional uses of the network: to provide traditional cellular service and to provide high-speed broadband,” said TBR Telecom Senior Analyst Chris Antlitz.

The TBR report said fixed wireless is a tool some operators will use to more cost-effectively protect and grow their internet service subscriber bases, while 5G technology will be leveraged for mobility to provide network efficiencies as well as faster data speeds and lower latency.

TBR estimates over 85 percent of communication service provider (CSP) 5G Capex spend will occur in four countries including the U.S., China, Japan and South Korea through 2020. Some operators in the U.S., China, Japan and South Korea will deploy 5G at scale, with the preliminary focus on the fixed wireless broadband and mobile broadband use cases, and IoT to follow.

The analyst report noted that AT&T and Verizon, to leading mobile service providers in the US, are investing in assets including spectrum and fiber to support 5G services.

“However, telecom operators are uncertain about the return on investment on 5G as demand for the technology and its use cases have yet to be proved,” TBR Telecom Analyst Steve Vachon said.

DSP transformation

Global telecom carriers are gradually transitioning from communication service providers to digital service providers (DSPs) to improve enterprise revenue growth. The shift towards DSP assumes significance because the 5G revenue growth will be primarily driven by IoT connectivity services.

DSPs will be leveraging network architectures like cloud and NFV/SDN, and employ new technologies, including big data, analytics, AIand automation, to provide value‐added services.

Enterprise customers and technology vendors are abandoning expectations for big IoT transformation projects in order to refocus on incremental adoption of smaller, tactical IoT tools.

Tech vendors will focus on delivering user-friendly components and pre-packaged IoT applications and services.

Though IoT will ultimately drive large percentages of IT vendor revenue, IoT-driven revenue will increase only at a moderate rate for many years. This challenges vendors to refine their IoT go-to-market strategies to be as efficient as possible.

Vendors change plans

SAP’s Leonardo Live in November 2017 featured very little about the IoT technology. SAP focused more on the business outcomes that can be achieved with various implementations of IoT and machine learning. This change from SAP’s other events shows that SAP is evolving to guide customers through their own transformations.

GE Digital, to leverage Predix to pave the way to positive changes for customers, refocused around the pre-packaging of industrial IoT (IIoT) applications to enable customers to build their own system of systems in H2 2017.

IBM evolved its IoT message during 2017. Instead of emphasizing IoT-based business transformation, operational efficiency gets top billing.

The three reports from TBR indicate that 5G Capex will be gradually growing after 2020 and IoT growth potential will support such investments.

Baburajan K