Leading technology research firm Analysys Mason has identified the growth potential of Wi-Fi market in India and suggested measures to grow investment and revenue further.

Analysys Mason – in a broadband report sponsored by Google – said over 600 million people will be accessing public Wi-Fi in 2019 in India if the country has the right telecom regulatory environment.

Analysys Mason – in a broadband report sponsored by Google – said over 600 million people will be accessing public Wi-Fi in 2019 in India if the country has the right telecom regulatory environment.

Positive market developments will trigger the deployment of up to 3 million access points or Wi-Fi hotspots in the country.

Most of these Wi-Fi hotspots will need to be connected through high-speed fibre optic links to ensure a high quality of service, comparable with what Google and Railtel already offer today.

Reliance Jio has 80,000 public Wi-Fi access points as of mid-2017. The Railtel / Google Wi-Fi project has around 10,000 access points in 400 railway stations. Other service providers such as Ozone, Tata, etc. have an additional 25,000 access points across the country.

Suggestions

Despite delicensing of Wi-Fi spectrum carried out in India, the country lags other developed and even developing markets in availability of unlicensed spectrum airwaves for Wi-Fi propagation.

The government has given only a limited quantity of unlicensed spectrum over 2.4GHz and 5.8GHz bands. Indian Internet consumers face poor coverage, while telecom operators face technical and cost inefficiencies in current Wi-Fi based network deployments due to technical restrictions on the radiated power of Wi-Fi access points in the 5.1-5.3GHz and 5.7-5.8GHz spectrum.

De-licensing spectrum in the 5.1 – 5.3 and 5.7 – 5.8GHz bands will ensure availability of Wi-Fi spectrum for offloading in urban area and hotspot deployment in rural areas. It will also relieve congestion in the 2.4GHz band which is the de-facto band for Wi-Fi deployment due no restrictions of licensing and technical power radiation.

Moreover, limiting access points to lower power (of 200mW) also acts as a constraint to Wi-Fi deployment. Increasing the limitation of EIRP for 5GHz frequency bands to the commensurate levels of 4W (as in the case of 2.4GHz frequency band) could help in making Wi-Fi deployment commercially viable through cost effective deployments.

The report said telecom regulator TRAI and DoT must consider de-licensing, or light licensing spectrum available in the millimetre-wave portion to provide alternatives to the industry to promote backhaul connectivity.

Countries such as the US, Canada and Australia are using the de-licensed V-band (60-GHz) as a viable alternative to 2.4GHz and 5GHz frequencies for carrying Wi-Fi traffic. India should license 60-GHz since the band enjoys good device ecosystem in the country.

Countries, including the US, UK and Australia, have adopted a light licensing framework for allocating the E-band which operates on a self-coordinated, first-come-first-served basis with a register maintained by spectrum authority.

This model typically resulting in lower fees for users and emergence of innovative use-cases such as high altitude balloons for connectivity. Therefore, a light licensing framework could enable widespread adoption.

The E-band (71 – 76GHz and 81 – 86GHz) has technological properties to provide high-capacity wireless links, especially suited for backhaul.

DoT’s current active infrastructure sharing requirements do not explicitly allow sharing of Wi-Fi infrastructure. Modification of active sharing requirements or explicit clarification regarding W-Fi sharing will be the right step.

India should rationalize import duty on Wi-Fi and WLAN equipment imported into the country. Wi-Fi and WLAN equipment currently attracts import duty of 10 percent for Access Point equipment, with an additional 12.5 percent and 4 percent applicable for Countervailing and Special Countervailing Duty.

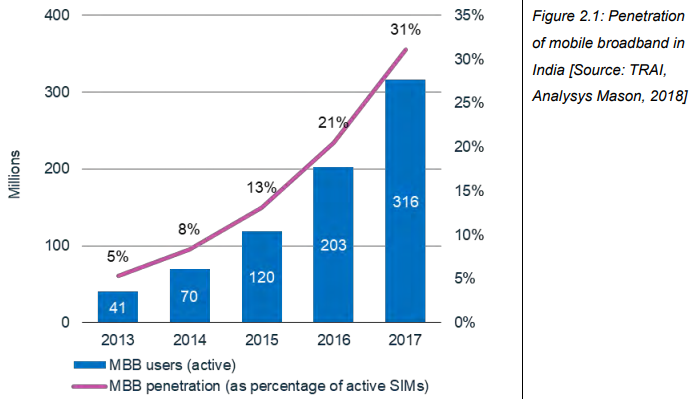

India has over 316 million active mobile broadband users with mobile broadband penetration of just 31 percent in 2017 — thanks to investment in 3G and 4G network rollouts. Airtel, Idea Cellular, BSNL, Vodafone and Reliance Jio have made significant investment in broadband networks to improve data ARPU.

The report said around 100 million people are willing to spend an additional $2 to $3 billion per year on handsets and cellular mobile broadband services as a result of experiencing fast broadband on public Wi-Fi.