The acquisition plan of AT&T to buy DirecTV – in a deal valued at around $40 billion — indicates the ARPU potential of the pay-TV industry in North America, despite several analyst reports indicating that the future subscriber growth will be in emerging markets.

Some reports indicate that deal size would be around $40 billion. The Wall Street Journal was the first publication to break the development.

Also read: U-verse TV added 201,000 subscribers to reach 5.7 million in service

Initial discussion between AT&T and DirecTV has already lifted the shares of the latter. The talks will also boost the proposed merger between Comcast and Time Warner Cable, analysts say.

AT&T, which earlier looked at Vodafone for an acquisition, may be considering the fact that Pay-TV ARPU in North America increased around 4 percent to $76 in 2013. The growth in ARPU is due to a growth in the proportion of customers with advanced pay-TV set-top boxes and upgraded High Definition programming packages.

The combined entity between AT&T and DirecTV will have a subscriber based or nearly 26 million. In April 2014, AT&T said ARPU for U-verse triple-play customers did not grow from $170.

“The global pay-TV market grew both in terms of subscribers and service revenue across all pay-TV platforms. Overall pay-TV service revenue reached almost $250 billion in 2013,” said Jake Saunders, VP and practice director of core forecasting, ABI Research.

There are some warning signals from ABI Research. The global pay-TV subscriber base increased over 5 percent in 2013 to 901.1 million. However, the average revenue per user (ARPU) dropped slightly to $23.80 in 2013 from $24.10 in 2012.

AT&T wants DirecTV to spread its wings in the video market, which will be threatened by Google, Verizon, etc. Comcast earlier cited Google as one of the main threats in the online video market in a bid to get support from FCC for its merger plan with TWC.

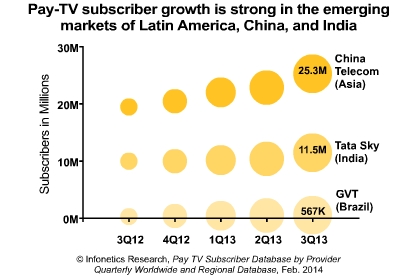

Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research, said in February: “What’s driving growth in pay-television are the emerging markets of Latin America, China, and India. India and Latin America are adding satellite and cable subscribers, while China is seeing an increase in IPTV subscribers.”

The top 5 satellite providers by subscribers are, in rank order, DirecTV US, DISH Network, DirecTV Latin America, Tata Sky, and British Sky Broadcasting, said Infonetics Research, in its research note on 20 February.

Also read: AT&T plans 2014 Capex of $21 billion

Stock market pundits say AT&T has a market cap of $185 billion and the acquisition will go through as DirecTV has a market cap of $42 billion.

The proposed Comcast-Time Warner Cable merger will create a new company with nearly 30 million customers.

AT&T has only 5.7 million customers for its video and broadband service. DirecTV has 20 million subscribers. So the combined user base will be around 26 million. AT&T has enough financial muscle to grab more to taken on Comcast-Time Warner Cable.

Baburajan K

[email protected]