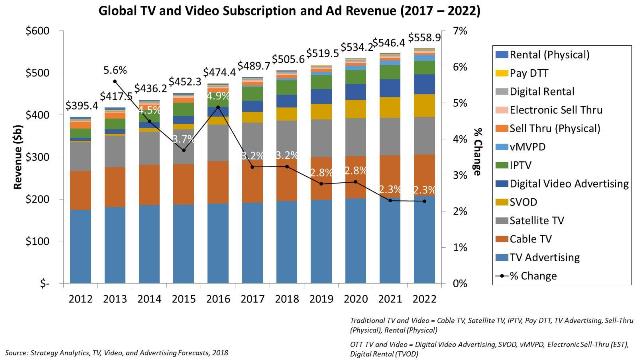

Global consumer and advertising spend on TV and video will grow from $490 billion in 2017 to $559 billion in 2022, a Strategy Analytics report said.

Spend on OTT video — such as YouTube, Facebook, iTunes, Google Play, Netflix, Amazon Prime Video, Hulu, DirecTV Now, NOW TV, Maxdome, iflix — will account for 90 percent of this growth.

Spend on OTT video — such as YouTube, Facebook, iTunes, Google Play, Netflix, Amazon Prime Video, Hulu, DirecTV Now, NOW TV, Maxdome, iflix — will account for 90 percent of this growth.

Consumer spend and digital video ad revenue from OTT video services will double over the forecast period, reaching $123 billion in 2022.

Traditional TV and video services will continue to account for the majority of consumer and advertising spend for the foreseeable future, Michael Goodman, director, Television & Media Strategies, said.

By 2022, consumer and advertising spend on traditional TV and video products and services globally will be over $435 billion, an increase of $7 billion from 2017, and account for nearly 78 percent of all TV and video revenue.

North America will continue to be the largest TV and video market in 2022 — accounting for 38.7 percent of global consumer and advertising spend on TV and video.

Cable (net loss of €987 million), pay satellite (net loss of €187 million), and pay DTT (net loss of €125 million) will see revenues decline over the next five years in Europe. IPTV will reach €9.9B in 2022, an increase of €1.5 billion.

Asia Pacific region will account for 23.4 percent of global consumer and advertising spend on TV and video in 2022 – driven by China and India.