Indian mobile operators are not yet ready for preparing their 5G plans because of the delay in the spectrum pricing auctions.

Telecoms such as Airtel, BSNL, Vodafone Idea and Reliance Jio are eager to spend during the upcoming 5G spectrum auction if the spectrum is available at a cost effective price. Airtel and Vodafone Idea have shared their concerns on the 5G spectrum price. India government is yet to reveal the final 5G spectrum price and conditions.

Telecoms such as Airtel, BSNL, Vodafone Idea and Reliance Jio are eager to spend during the upcoming 5G spectrum auction if the spectrum is available at a cost effective price. Airtel and Vodafone Idea have shared their concerns on the 5G spectrum price. India government is yet to reveal the final 5G spectrum price and conditions.

Airtel, Vodafone Idea and Reliance Jio could not improve the monthly ARPU from their 4G services due to competition in the market. Indian mobile ARPU of telecom operators reached nearly INR 150 ($2 plus) indicating lack of viability of the telecom sector in the country with a mobile population of more than 1 billion.

Some markets have grown revenue with 4G services. But majority of countries have found that 4G acts as a modest brake on consumer expectations, fueled by competitive pressure between operators, to spend less each month on more and more data, Strategy Analytics said in a report.

Globally, 4G grew from 4 percent of all mobile subscriptions in 2012 to 61 percent in 2018. But mobile service revenue increased by less than 1 percent between 2012 and 2018. Indian telecoms’ revenue growth is better as compared with the global average because of the low revenue at present.

Plus, there is enough space for Indian telecoms to enhance their 4G coverage across the country.

If there is further delay in the availability of cost effective 5G smartphones, Indian telecoms will be in a tough position to launch 5G services. At present, majority of the global telecoms are launching 5G without any premium. In fact, their 5G pricing is equivalent to 4G pricing at present.

On top of this, telecoms are yet to target enterprise customers with their 5G data plans. 5G-powered IoT will trigger pick up of 5G services among enterprises. But India needs to wait at least 3-4 years to generate considerable revenue from business clients.

Strategy Analytics said 5G networks will generate 26 percent of wireless service revenue in 2024 in a stagnating global wireless market.

5G forecast for India

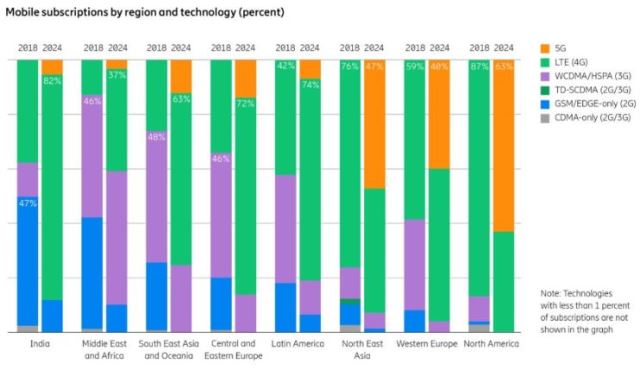

The latest Ericsson Mobility report said 5G subscriptions in India will be available in 2022 and will represent 6 percent of mobile subscriptions at the end of 2024. LTE is forecast to represent 82 percent of mobile subscriptions by the end of 2024.

GSM/EDGE-only accounted for 47 percent of mobile subscriptions at the end of 2018. LTE subscriptions accounted for 38 percent of mobile subscriptions.

Globally, 5G market will begin to build real momentum in 2021 as network coverage improves, phone prices fall, and use cases mature.

“5G’s impact will be equally disappointing,” Phil Kendall, director of Strategy Analytics’ Service Provider Group, said.

“Once 5G device prices begin to fall in 2021, the challenge for operators will then be how to monetize the significant additional capacity that the more widely deployed 5G networks will bring,” Phil Kendall said.

Success of 5G operators will depend on the execution of a needs-based segmentation of their customers’ 5G motivations, rather than compete on who has the fastest network and biggest data plans.

4G LTE networks will have over 6 billion subscriptions by the end of 2024, over two thirds of all wireless subscriptions. 4G LTE platforms will evolve though LTE-Advanced and LTE-Advanced Pro technologies before starting 5G.

“LTE continues to have a bright future with much of Africa and Middle East still clinging to older generations,” David Kerr, senior VP Global Wireless Practice, said.

The June 2019 edition of the Ericsson Mobility Report forecasts 1.9 billion 5G subscriptions – up from 1.5 billion forecast in the November 2018 edition – an increase of almost 27 percent.

5G coverage is forecast to reach 45 percent of the world’s population by end of 2024. This could surge to 65 percent, as spectrum sharing technology enables 5G deployments on LTE frequency bands.

Baburajan K