The global pay-TV market size including cable and satellite TV, telecom IPTV increased 5 percent to $221 billion in 2013, said Infonetics Research.

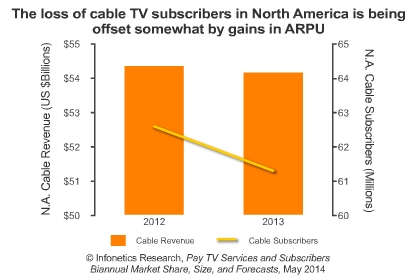

Growth resulted from pay-TV providers in mature markets increasing average revenue per user (ARPU) among slow-growing/declining subscriber bases, and from operators in emerging markets continuing to see significant subscriber growth.

Pay-TV subscribers grew 5 percent in the second half of 2013 to 756 million subscribers, with the strongest growth coming from the telecom IPTV segment.

DirecTV, the global market leader for pay-TV service revenue, has one of the highest ARPUs in the industry, which is helping it offset a slowdown in net new subscribers.

Future of video services market

Infonetics Research said the overall video services ARPU and revenue growth will be constrained.

“This is because of the result of increasing competition from OTT (over-the-top) players and the service providers themselves using broadband video as a lower-priced offering,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

The research agency has reduced its 2017 pay-TV revenue forecast by 35 percent globally, from $401 billion to just under $260 billion.

Interestingly, AT&T is planning to acquire DirecTV in a deal valued at $48.5 billion to strengthen its video business and reduce pressure from wireless business.

TelecomLead News Team