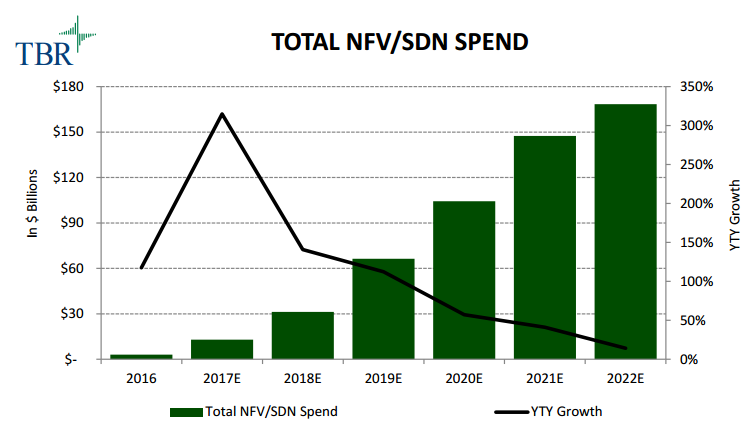

Spend on NFV and SDN is expected to grow at a 94.3 percent CAGR from 2016 to 2022 to over $168 billion, according to Technology Business Research.

Spend on NFV and SDN is expected to grow at a 94.3 percent CAGR from 2016 to 2022 to over $168 billion, according to Technology Business Research.

NFV and SDN spend will scale through as telecom operators work through the ongoing internal challenges. Technology as vendors will align with the market shift to meet the new needs of their telecom operator clients.

There will be huge investment in NFV and SDN technologies because telecom operators are under pressure to transform their businesses to improve financial results and remain competitive in the digital business.

EY, in its report on digital transformation for telecoms, said telecoms have expanded their service to areas such as enterprise cloud, TV and the Internet of Things (IoT). Key challenge for telecoms is that adjacent market segments tend to offer lower margins, and disruptive competitors are already well-positioned in key segments such as cloud and advertising.

TBR’s Telecom Senior Analyst Chris Antlitz said: “This pressure will push operators to embrace NFV/SDN because the traditional way of doing business in the telecom industry is not optimized for the data-driven digital economy, requiring operators to adapt or fade from relevancy.”

TBR’s Telecom Senior Analyst Chris Antlitz said: “This pressure will push operators to embrace NFV/SDN because the traditional way of doing business in the telecom industry is not optimized for the data-driven digital economy, requiring operators to adapt or fade from relevancy.”

The TBR research report noted that technology interoperability, human resource challenges and operator-vendor disagreements, among other issues, have limited adoption of NFV and SDN technologies.

Ovum analyst Nicole McCormick in December 2016 said SDN and NFV still just a tier-1 operator reality, but emerging markets build it into their new mobile-fixed network contracts.

Some tier-1 CSPs have launched software-defined networking (SDN) and commercialized NFV-enabled services.

AT&T says more than 1,200 businesses across multiple industries have signed up for AT&T’s Network on Demand solution, which was launched in 2015. AT&T’s Network on Demand offers virtualized services such as virtualized access routers for enterprises. AT&T aims to virtualize 75 percent of its network by 2020.

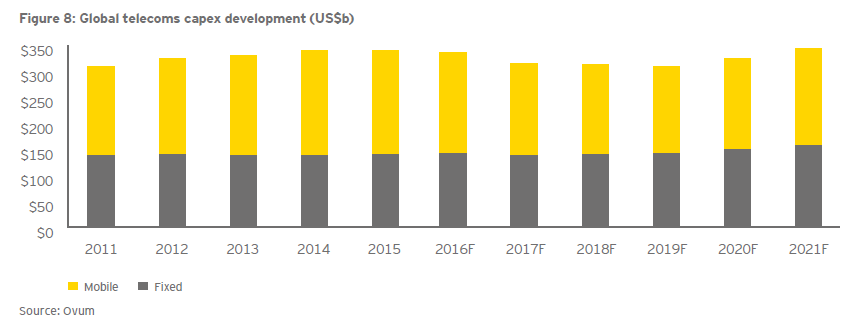

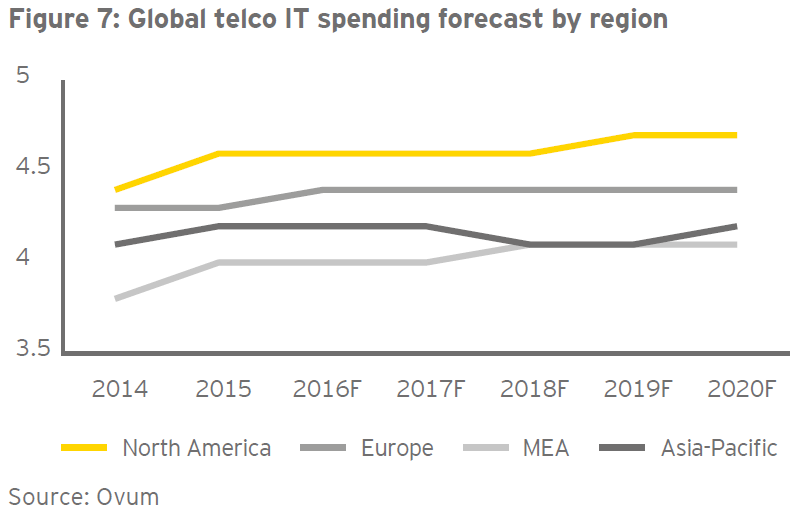

Meanwhile, Ovum said global telecoms’ IT investment will reach $85 billion in 2020, with 74 percent of this total being spent with external providers rather than internally. Growth in spending on systems hardware and packaged software will be particularly strong, reflecting the move to more flexible virtualization technologies.

Internal IT spending on areas like IT desktop capabilities and IT departments will see relatively slow growth between 2015 and 2020, at a CAGR of 1 percent, according to Ovum.

Internal IT spending on areas like IT desktop capabilities and IT departments will see relatively slow growth between 2015 and 2020, at a CAGR of 1 percent, according to Ovum.

Ovum says numerous other tier-1 telecoms are yet to commercially deploy SDN / NFV. SDN / NFV upgrades have been led by mobile operators in western Europe, Japan, and the US. A lot of tier-1 market players in Asia are choosing to wait and see the successes of NFV before commercializing these.

Emerging market operators in Asia sign vendor contracts that involve reorganizing their fixed and mobile networks into cloud-based infrastructure, ready for 5G and IoT, and that includes incorporating SDN/NFV upgrades into the contracts.

TBR said a group of 20 to 25 Tier 1 operators have driven the vast majority of spend in the NFV / SDN market, and Tier 1 operators are expected to remain the key investors in NFV/SDN through the forecast period, with Tier 2 and 3 operators joining en masse in the later years.

The telecom industry will see measurable cost savings from the use of NFV / SDN starting in 2021. The spend reduction will stem predominantly from lower hardware and hardware-attached services spend, thanks to the use of commodity solutions.

Savings will show up first in preliminary use-case areas such as in the customer premise equipment (CPE), evolved packet core (EPC), IP Multimedia Subsystem (IMS), content delivery network (CDN) and SDN domains.

One of the key reasons cost savings will not materialize sooner at an aggregate level is because operators need to fully transition domains over to NFV or SDN and retire legacy infrastructure. At present, operators are using stand-alone NFV/SDN and legacy environments concurrently.

Baburajan K

editor@telecomlead.com