Fitch Ratings said it expects the median net debt/EBITDA for three mobile operators – AIS, DTAC, and True Mobile in Thailand – to rise to 1.8x in 2018 from 1.3x as FCF will be negative.

Fitch Ratings said it expects the median net debt/EBITDA for three mobile operators – AIS, DTAC, and True Mobile in Thailand – to rise to 1.8x in 2018 from 1.3x as FCF will be negative.

Aggregate FFO will be at around THB120 billion from THB106 billion, but still unlikely to cover Capex (THB139 billion) and dividends (THB20 billion).

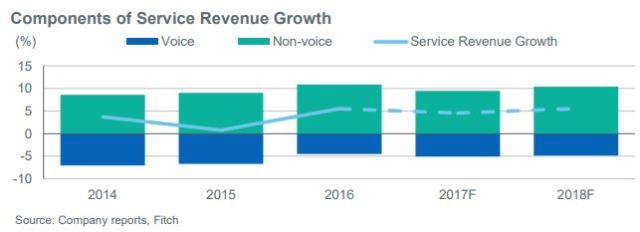

Service revenue of Thailand telecom operators in 2018 will grow by 5 percent-6 percent, supported by the strong demand for data – particularly video and music streaming.

The median EBITDA margin for the telecom sector in Thailand is likely to improve to around 40 percent from 38.6 percent in 2017, led mainly by the continued reduction in the handset subsidy expense.

Operators will receive a full year’s benefit of the May 2017 cut in the universal service obligation (USO) fee to 2.5 percent of license-holders’ service revenue, from 3.75 percent.

Price competition in the Thai telecom sector will stabilise in H2 2017 and into 2018 as operators shift their focus to profitability rather than market share, and scale down their handset subsidies.

AIS and DTAC have been reducing handset subsidies since H1, and offering subsidies only on post-paid plans. True Mobile will reduce its handset subsidies for the pre-paid segment in 2H17 and 2018, after having passed DTAC in service revenue market share in H1.

DTAC has the most need for spectrum among the three largest operators as it needs new spectrum to replace the 35MHz spectrum that is part of the 2G concession expiring in 2018. DTAC is likely to participate in the 1.8 GHz and 850 MHz spectrum auctions which will probably take place in 2018, as the company still relies on these frequencies to provide 3G and 4G service.

The auction starting prices will be high, and likely to be similar to the final prices in the previous 1.8 GHz and 900 MHz auctions in 2015 and 2016.