IHS Markit has revealed the forecast for the global network functions virtualization (NFV) market.

IHS Markit has revealed the forecast for the global network functions virtualization (NFV) market.

The size of the NFV market — includes NFV hardware, software and services — will be $15.5 billion by 2020, according to the latest NFV Hardware, Software, and Services Annual Market Report from IHS Markit.

“Between 2015 and 2020, the service provider NFV market will grow at a robust compound annual growth rate (CAGR) of 42 percent — from $2.7 billion in 2015 to $15.5 billion in 2020,” said Michael Howard, senior research director, Carrier Networks, at IHS Markit.

NFV represents the shift in the telecom industry from a hardware focus to a software focus, with mobile operators making much larger investments in software than in server, storage and switch hardware.

NFV software will comprise 80 percent of the $15.5 billion total in 2020 — or around $4 out of every $5 spent on NFV.

In 2020, 11 percent of NFV revenue will be attributable to new software and services. 16 percent will come from network functions virtualization infrastructure (NFVI) — servers, storage, switches — acquired in place of purpose-built network hardware such as routers, deep packet inspection (DPI) products and firewalls.

The remaining 73 percent will originate from existing market segments, primarily virtual network functions (VNFs). The main value of NFV is in its applications or VNFs.

The telecom service provider NFV market is larger than the software-defined networking (SDN) market throughout 2020, due to the pre-existing and ongoing VNF market.

“We expect strong growth in NFV markets in 2020 and beyond, driven by service providers’ desire for service agility and operational efficiency,” said Howard.

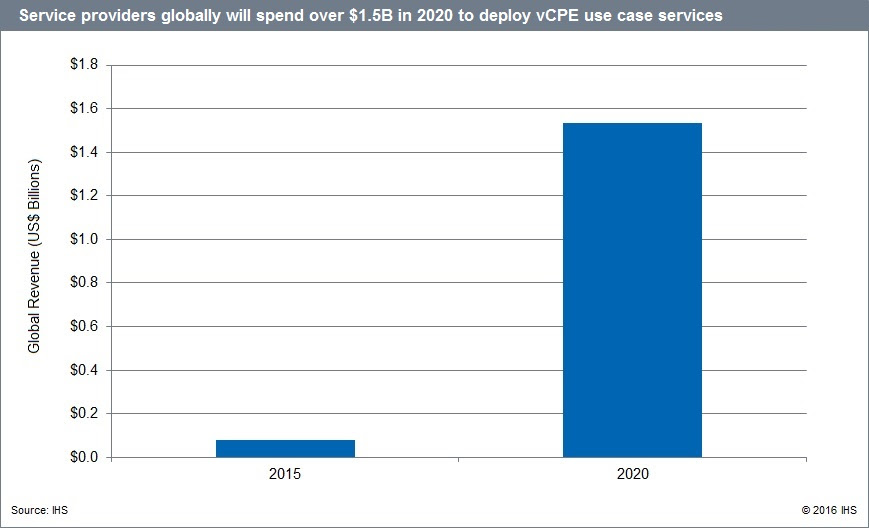

The consumer virtual customer premises equipment (vCPE) and enterprise vCPE spending to deploy consumer and enterprise services is forecast to reach over $1.5 billion worldwide by 2020, said IHS Markit.

Other NFV reports

According to SNS Research, telecom service provider SDN and NFV investments will grow at a CAGR of 54 percent between 2015 and 2020. The report says since telecom service providers seek to reduce costs and virtualize their networks, these investments will eventually account for over $20 billion in revenue by the end of 2020.

A telecom analysis report on the global NFV, SDN & Wireless Network Infrastructure Market 2016 – 2030 at RnRMarketResearch.com indicates that telecom service providers are expected to invest over $12 billion in NFV deployments by 2020.

The research estimates that NFV and SDN investments on service provider networks will account for over $18 billion. These investments will initially focus on EPC/mobile core, IMS, policy control, CPE (Customer Premises Equipment), CDN (Content Delivery Network) and transport networks.

Industry comments

Ultan Kelly, TeraVM Product Director, Cobham Wireless, said: “IHS’s bullish forecast on market potential of NFV illustrates the fascinating evolution currently taking place in the telecoms industry. However, if virtualisation is going to be as widespread as these findings suggest, it is absolutely vital that these networks go through thorough stress and interoperability testing.”

Without sufficient NFV validation the significant investment being made by operators will be at risk and the evolution to virtualised network functions will not deliver the quality of service available from existing hardware-centric networks.

Jonathan Bell, VP Marketing at OpenCloud, said: NFV should enable the fixed and closed nature of traditional hardware-based network appliances to be broken-open. However, to ensure this, operators need to be smart about how they choose to virtualise the various functions in their networks.”

Many telecom operators are choosing to outsource NFV to a single network equipment provider (NEP), but doing this may mean following the same vendor equipment lock-in path that they have always taken, with limited flexibility and opportunity for competitive differentiation.

Locking themselves into a big closed VNF environment waters down the original aims and benefits of virtualisation. To compete, telecom operators need to have control over the composition of their VNFs, so they can utilise the various components to differentiate their services in the market.

Baburajan K

[email protected]