A GSMA report has revealed the main demands of telecom operators to meet data demands in big cities and grow business revenue.

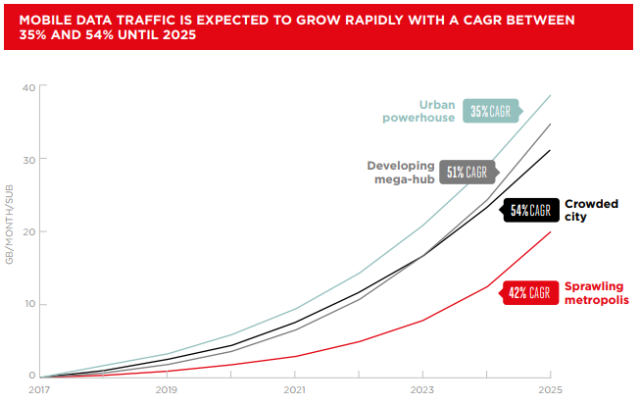

According to BCG, factors such as 5G mobile and the growth of the Internet of Things (IoT) will cause mobile data demand to grow by more than 50 per cent in major cities across the world by 2025.

ALSO READ: Latest news from Mobile World Congress 2018

Big cities such as New York, Shanghai, Shenzhen and Tokyo will face a gap between mobile data traffic demand and network capacity. 48 percent of traffic demand will be un-served in dense urban areas by 2025.

As a result, mobile operators’ capital and operational expenditures in big cities would need to triple to provide sufficient network capacity. Incidentally, telecom operators do not have plan to enhance their Capex to meet such demands.

What GSMA wants

# Release additional affordable spectrum

# Facilitate deployment of fronthaul and backhaul infrastructure

# Provide more access to advantageous macro-cell and small-cell sites

# Allow network sharing agreements

# Enable small-cell deployment

# Harmonise power density limits

John Giusti, chief regulatory officer of GSMA, said: “Unless government policies encourage investment, the network capacity required to satisfy future demand is unlikely to be achieved.”

Concerns of telcos

Concerns of telcos

Small cell deployment is expensive for all telecom operators. It can take many small cells to match the capacity of one macro cell — as many as 30 times more in urban powerhouses and 10 times more in developing mega-hubs. Rent for a single small cell installation is very high compared to rent for a macro cell.

Previous improvements in technology, such as 3G and 4G, did not bring revenue growth by themselves. BCG indicated that 5G services many not lead to additional revenues for operators. End users or content providers should be willing to pay for such new uses as in-vehicle entertainment or augmented and virtual reality. On top of this, ARPU is declining in all markets.

Mobile operators’ Capex and Opex costs will triple in urban powerhouse cities by 2025 and double, at least, in each of the other urban archetypes in order to provide sufficient network capacity.

If operators cannot increase their revenues substantially to support huge escalations in Capex spending, a significant gap between forecast data traffic demand and network-capacity supply could open over time, said GSMA.

Cities with high traffic densities will reach the capacity limits of their macro networks earlier while small cell deployment remains financially restricted. BCG projects that 45 percent to 48 percent of traffic demand could go unserved in ultra-dense urban areas by 2025.

Even in less dense megacities, where densification on the macro grid is possible, network capacity will not be sufficient to keep up with the rapidly growing demand. The projected supply-demand gap will be 14 percent to 21 percent in 2025 in sprawling metropolises and crowded cities.