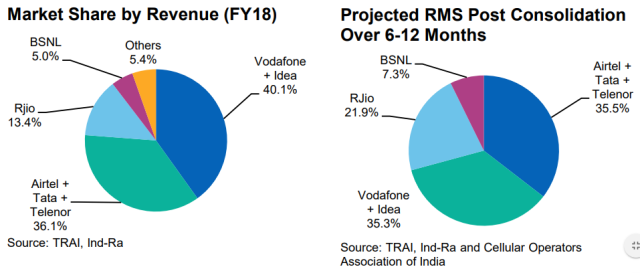

India Ratings analysts Tanu Sharma and Prashant Tarwadi indicate that Airtel will lead the Indian telecom market in terms of revenue ahead the Vodafone Idea and Reliance Jio even after the merger between Vodafone and Idea.

Airtel, which has acquired Tata Teleservices’ mobile business and Telenor India, will have a revenue market share of 35.5 percent against Vodafone Idea’s 35.3 percent, Reliance Jio’s 21.9 percent and BSNL’s 7.3 percent.

Airtel, which has acquired Tata Teleservices’ mobile business and Telenor India, will have a revenue market share of 35.5 percent against Vodafone Idea’s 35.3 percent, Reliance Jio’s 21.9 percent and BSNL’s 7.3 percent.

Airtel had 36.1 percent revenue share in fiscal 2018 against Vodafone plus Idea’s 40 percent, Reliance Jio’s 13.4 percent and BSNL’s 5 percent. The gainer will be Reliance Jio during the consolidation stage.

Phase of crisis

As a result of uncertain market conditions, India Ratings and Research has maintained a negative-to-stable outlook on the telecommunications services sector for the remainder of FY19. The report specifically mentioned that the Indian telecom industry’s pricing power is yet to return.

India Ratings has illustrated several reasons for its remarks on the health of the telecom industry.

First, ARPU for Bharti Airtel and Idea Cellular were 7 percent-9 percent lower than Ind-Ra’s full year forecast of INR110-113. Airtel and Idea Cellular reported lower ARPU due to their inability to increase cellular tariffs due to hyper competition in the market.

Second, the outlook on Vodafone Mobile Services is Negative due to the high leverage ratio of the merged Vodafone – Idea, which is unlikely to meaningfully improve in FY19. This is because free cash flows are negative, necessitating refinancing of debt obligations in FY19. The Capex and Opex synergies for the merged entity are likely to accrue gradually.

Third, the AAA/Stable rating of Reliance Jio Infocomm continues to reflect support from the parent company Reliance Industries (RIL).

The report said the industry will be in the stabilisation phase, with Vodafone Idea merger finally approved and the merged entity looking to integrate its networks.

The revenue market shares of all the mobile operators will evolve over FY19, in line with their share of 4G data subscribers.

Fourth, Reliance Jio’s quest for incremental market share is likely to continue at least till it reaches around 30 percent from the current subscriber market share of 18 percent. The subscriber market share for Reliance Jio could increase up to 23 percent by end-FY19. This means that the pricing environment could remain tough even in H1 FY 2020.

ARPU decline will be contained and ARPUs will bottom out in FY 2019, as the current ARPUs are unsustainable from the cost and returns perspectives.

Fifth, data monetisation will be a challenge for telcos in FY19, despite a multi-fold increase in the data usage. Jio is the dominant telco in mobile broadband space, enjoying 50 percent subscriber market share. Jio has achieved above industry-average ARPU of INR135 vs INR 100.

Sixth, the lower ARPUs in Q1 FY 2019 and no uptick in pricing plans so far lowers the possibility of revenue growth for the industry. The sale of non-core businesses such as tower assets would also contribute to a revenue decline in these business streams.

Bharti Airtel’s mobile services India revenue declined 19 percent to INR 104 billion, and EBITDA declined 38 percent to INR 28 billion in Q1. Despite an increase in data and voice usage, ARPU declined to INR 105 in Q1 fiscal 2019 from INR 154 in Q1 fiscal 2018 and INR 116 in Q4 fiscal 2018.

Jio’s operating revenue grew 13.8 percent quarter on quarter to INR 81 billion and EBITDA grew 16.8 percent to INR 31 billion. Jio’s ARPU fell 1.9 percent to INR 134.5.

Once pricing improves, the positive margin impact will be significant due to the high fixed cost structure. Mobile phone customers will be moving towards single SIM from the present double SIM scenario.

Capex

Telecom Capex in FY19 will be towards network augmentation, technology investments and innovative offerings to capitalise on the rising trend of convergence of telecom and media in line with developed markets.

Telecom operators will be making investment in fibre backhaul network and site upgradation and decongestion.

The focus on telecom operators will be in making investment in VoLTE and 5G ecosystem. India has about 1.5 million kilometres of optical fibre cable, and less than one-fourth of the towers are fibre-connected.

“As wireless platforms are not equipped to handle the gigantic increase in data traffic, optic fibre connectivity is the prerequisite for migrating to high speed broadband,” the report said on Tuesday.

“The remainder of fiscal 2019 may not witness active participation in 5G spectrum auctions due to other Capex priorities, an immature ecosystem for 5G and stretched leverage profile. Any disruption from 5G is therefore unlikely in the near term,” India Ratings analysts Tanu Sharma and Prashant Tarwadi said in the research note.

Free cash flows are likely to remain negative for the second consecutive year, as Capex to revenue ratio for telcos to remain at 25 percent-30 percent in FY19. This indicates a Capex estimate of around INR 500 billion on a revenue base of INR 1.8 trillion.

Baburajan K