Equity firm Motilal Oswal has revealed the difference in Capex (capital expenditure) of Airtel and Vodafone Idea.

Bharti Airtel is the number two telecom operator in India. On the other hand, Vodafone Idea is the third largest mobile service provider.

Vodafone Idea’s Capex intensity rose to INR 10.4 billion in 2QFY21 vs INR 6 billion in 1QFY21.

For comparison, Bharti Airtel’s Capex was INR65 billion in 2QFY21 and INR110 billion in 1HFY21.

Vodafone Idea added ~10,000 4G FDD sites, primarily through refarming of the 2G/3G spectrums, to expand 4G capacity.

Vodafone Idea has deployed ~61,300 TDD sites, in addition to ~12,400 massive MIMO sites and ~11,800 small cells, to date.

Vodafone Idea has the fastest 4G download speed across the circles of Delhi, West Bengal, and Madhya Pradesh based on speedtest intelligence data from Ookla.

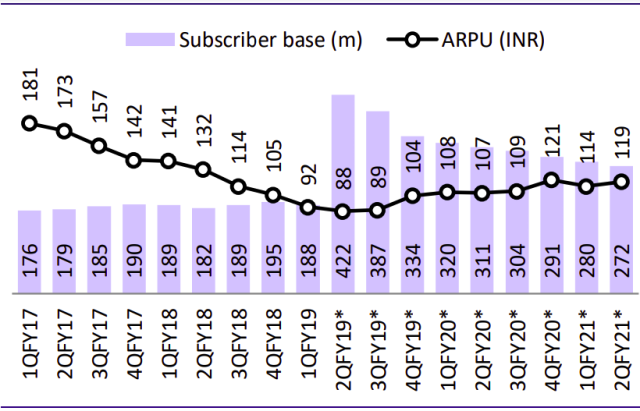

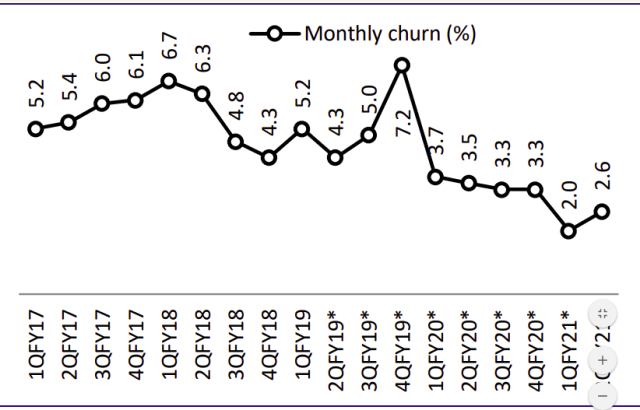

Vodafone Idea lost 8 million customers (-3 percent QoQ) to reach 271.8 million. Active subs declined more sharply by 11.8 million to 261.2 million. Though gross adds improved with the gradual resumption in retail, churn increased to 2.6 percent in 2QFY21 vs 2 percent in 1QFY21, dragging down the subscriber base.

For comparison, Bharti Airtel added 14 million subscribers, indicating a big market share capture from Vodafone Idea.

Meanwhile, Fitch Ratings today said Reliance Jio and Bharti Airtel will gain revenue share at the expense of Vodafone Idea to dominate 75 percent- 80 percent of the market, from around 70 percent currently.

This would see Vodafone Idea lose 50 million-70 million subscribers in the next 12 months, after losing about 155 million subscribers in the last nine quarters, says Fitch Ratings.

Vodafone Idea’s Data/Broadband subscribers increased by 1.8 million / 3.4 million in 2QFY21 to 137.5 million /119.8 million. This was still better than decline of 6 million / 2 million seen in the last two quarters.

Vodafone Idea’s 4G subs stood at 106.1 million, reflecting 1.5 million increase vs a decline of 1 million in 1QFY21. For comparison, Bharti Airtel added 14.5 million 4G users on its LTE network.

Vodafone Idea’s ARPU rose 4.4 percent QoQ to INR119 v/s 6 percent decline in 1QFY21. For comparison, Airtel posted 3 percent QoQ growth in ARPU.

Vodafone Idea’s data traffic grew 7.7 percent QoQ to 4.8 billion GB; Data usage/subs was up 5 percent QoQ to 11.5 GB. For comparison, Bharti Airtel’s data usage/subs was at 16.4 GB.

The report from Motilal Oswal said Vodafone Idea has added significant capacity and high capex in the upcoming quarters is unlikely. The report said Capex would be the same as 2Q levels.

Vodafone Idea would drive priority 4G investments in 16 telecom circles to boost revenues and subscriber growth. However, it would continue to make only the necessary investments in the other 6 circles.

Vodafone Idea is facing churn in subscribers due to network quality issues, improvement in ARPU is not translating into revenue benefits. Vodafone is losing its competitive positioning with the continuous subscriber churn.

Furthermore, a weak liquidity position has restricted its ability to invest in networks, which has led Vodafone Idea to focus on 16 out of 22 circles. This could limit growth and further erode its competitive position.

Vodafone needs a ~70 percent ARPU hike merely to fulfill its interest obligation, capex, and AGR installment dues in FY22.