The latest report from Indian telecom regulator TRAI shows how mobile operators changed the mobile Internet space in the country despite struggling to generate enough funds for their growth.

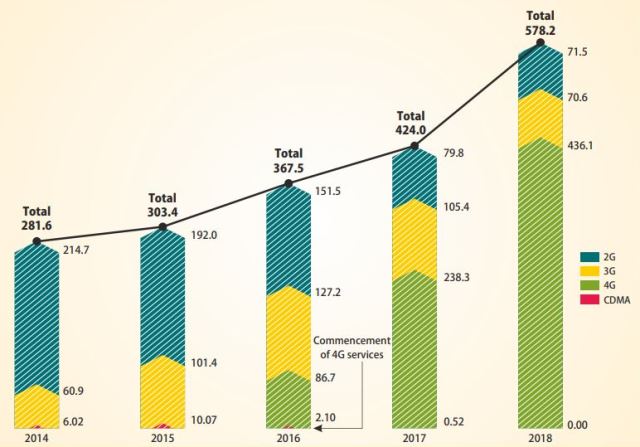

The number of 4G data subscribers increased in India to 436.12 million in 2018 from 238.3 million in 2017, according to the latest statistics from TRAI.

India’s 3G mobile data subscriber base fell to 70.6 million in 2018 as compared with 105.4 million in 2017 as the shift to cost-effective 4G smartphones started escalating during the last 12 months.

The 2G mobile data subscriber base dropped to 71.5 million in 2018 from 79.8 million in the wake of a shift to better data speed on 4G networks across India.

Volume of 4G data usage increased 145.37 percent in 2018 over the previous year. The spike in the growth was driven by promotional offers from telecom operators such as Bharti Airtel, Vodafone Idea and Reliance Jio.

Volume of 2G and 3G data usage yearly increased by 4.74 percent and 77.39 percent in the year 2018.

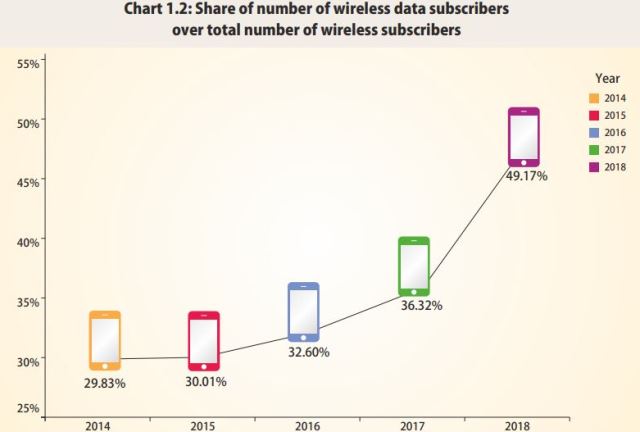

TRAI said total number of wireless data subscribers increased 36.36 percent from 424.02 million in 2017 to 578.20 million in 2018.

The total volume of wireless data usage rose 131 percent from 20,092 million GB in 2017 to 46,404 million GB in 2018. The share of 4G data usage in total volume of wireless data usage reached 86.85 percent in 2018.

Telecom operators generated revenue of Rs 54,671.44 crore from mobile data business (excluding rental revenue) in 2018 as compared to Rs 38,882 crore in 2017.

The volume of average wireless data usage per wireless data subscriber per month has increased from 4.13 GB in 2017 to 7.69 GB in 2018.

The average cost to subscriber for per GB wireless data usage was Rs 11.78 per GB during 2018 as compared to Rs 19.35 per GB during 2017.

Average cost to subscriber for wireless data was Rs 226 per GB during 2015 — before the launch of 4G LTE technology.

Average revenue per wireless data subscribers (data ARPU) per month rose from Rs.79.98 in 2017 to Rs 90.61 in 2018. The lack of ability of operators to enhance data ARPU has already impacted their funding in mobile network.

Increase in spectrum price and capital expenditure in the wake of rapidly growing customer base is putting additional pressure all telecoms in India. Several telecom operators have already demanded India government to lower the price of 5G spectrum.