Idea Cellular announced its financial results and coverage of 2G, 3G and 4G services during the first quarter of fiscal 2017.

The Aditya Birla group company has more 4G coverage in rural India as compared with towns. The investment in rural telecom markets indicates that there is demand for 4G among financially backward Indians as well. Bharti Airtel, Vodafone India and Reliance Jio are yet to share their 4G coverage.

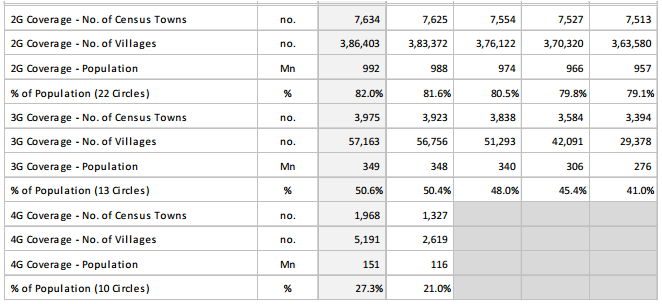

4G coverage of Idea Cellular reached 1,968 Indian towns in 1QFY17, compared to 1,327 in Q4FY16. 5,191 villages have received 4G services from Idea Cellular in 1QFY17, in comparison with 2,619 in the last quarter of 2016. The data indicates that Idea Cellular is progressing fast in rural markets than towns.

Also, the number of 3G Devices, including 4G devices, being used with the network increased to 61.4 mn in Q1FY17, compared to 60.4 mn in Q4FY16, 55.5 mn in Q3FY16, 48.7 mn in Q2FY16, and 42.3 mn in Q1FY16.

Out of the above, 4G Devices grew to 14.2 mn in Q1FY17, from 11.1 mn in Q4FY16, and 6.1 mn in Q3FY16.

3G coverage of Idea Cellular was available in 3,975 towns in 1QFY17 against 3,923 in Q4FY16, 3,838 in Q3FY16, 3,584 in Q2FY16 and 3,394 in Q1FY16.

57,163 villages have received Idea Cellular’s 3G services in 1QFY17 against 56,756 villages in Q4FY16, 51,293 in Q3FY16, 42,091 in Q2FY16 and 29,378 in Q1FY16.

While 2G coverage of Idea Cellular reached 7,634 towns in 1QFY17 against 7,625 in Q4FY16, 7,554 Q3FY16, 7,527 in Q2FY16 and 7,513 in Q1FY16. Idea Cellular coverage 3,86,403 villages in Q1FY17, compared to 3,83,372 in Q4FY16, 3,76,122 in Q3FY16, 3,70,320 in Q2FY16, and 3,63,580 in Q1FY16.

Also, 2G cell sites of Idea Cellular grew to 127,835 in 1Q2017 from 1,15,575 in the first fiscal quarter of 2016.

At the same time, 3G cell sites touched 51,231 in 1Q2017, from 33,621 in 1Q2016 and a net of 50,060 in the fiscal year 2016.

Meanwhile, for 4G, the cell sites increased to 19,939 in 1Q2017 from 14,643 in 1Q2016.

Idea Cellular, the sixth largest operator in the world, with a Revenue Market Share (RMS) of 19.3 percent (Q4FY16), has a subscriber base of 175.1 mn in the first fiscal quarter of 2016 compared to 157.8 mn in the previous year quarter. The group also saw an addition of 14,643 4G EoPs in 2016 compared to none in 2015.

Strategies of Idea Cellular were to go for a volume growth led strategy for mobile data business in high investment and low capacity utilization resulting in the highest ever 5 million mobile data user addition on quarterly basis making the data subscriber base 49 million.

The company hiked Capex (capital expenditure) guidance to Rs 6,000 crore to Rs 6,500 crore, betting on the LTE service launch in 2016 in a phased manner. The Capex guidance does not include Idea’s investment towards spectrum acquisitions during the auction.

Idea Cellular added that the wireless broadband consumer demand growth is slower than increased supply from operators launching or expanding 3G and 4G footprints, adding to the competition and resulting in price cuts from the operator. Telecom operators cut down pre-paid data tariffs to amplify data consumption, last month with Idea offering 54 percent more data for the same fees, while rival Bharti Airtel is providing a high 67 percent.

Spectrum acquisition in March 2015 and February 2014 and the investment of Rs. 301.4 billion in March 2015 for renewing mobile licenses in 9 service circles, which had their expiry in the period between December 2015 and April 2016, were blamed for the fall in profits. Also, investments done in launch of 4G services in 10 circles; introduction of 3G 2nd carrier on 900 MHz in Maharashtra & MP; and launch of 3G services in Kolkata metro during FY16, hiked the capex for the telecom.

States of Kerala, Madhya Pradesh, Maharashtra and Uttar Pradesh (West) bagged the top revenue market shares, conveyed the company.

Key Operational Indicators

The subscriber base of the group, for both 2G and 3G touched a figure of 176.2 mn in Q1FY17, compared to 175.1 mn in Q4FY16, and 171.9 mn in Q3FY16, 166.6 mn in Q2FY16, and 162.1 mn in Q1FY16.

The number of VLR subscribers (EoP) has gone down to 183.2 mn in Q1FY17 against 183.9 mn in Q4FY16,181.9 mn in Q3FY16, 170.8 mn in Q2FY16, and 165.8 mn in Q1FY16.

Net average Revenue per User (ARPU) touched INR 181 in Q12017, from 179, 176, 175, and 182 in Q4FY16, Q3FY16, Q2FY16, and Q1FY16, respectively.

Vina Krishnan

[email protected]