Indian mobile phone users are considering Jio 4G connection for their secondary SIM, according to a Bank of America Merrill Lynch survey.

Indian mobile phone users are considering Jio 4G connection for their secondary SIM, according to a Bank of America Merrill Lynch survey.

The Bank of America Merrill Lynch survey covered 1,000 mobile phone users — mostly with dual SIMs — across India to understand their behavior and preferences and the issues they face with mobile service.

The survey was done after the 4G launch by Reliance Jio Infocomm on September 5. About 75 percent of these consumers have monthly bills of Rs 250 or more (potential target segment for Jio).

HIGHLIGHT

95 percent of customers were largely satisfied with their current mobile operator — 22 percent extremely satisfied; 39 percent very satisfied and 34 percent somewhat satisfied

92 percent of consumers intend to watch more videos / surf more if tariffs decline

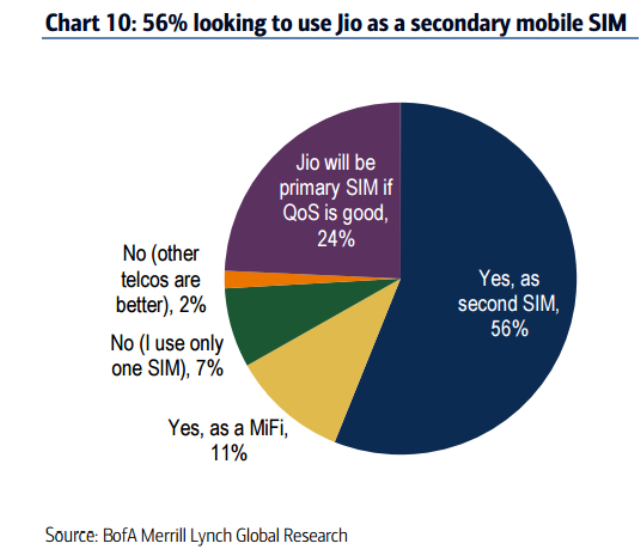

67 percent are keen to use Jio as a secondary SIM / MiFi and 24 percent may look at using Jio as a primary SIM if the quality is good

72 percent intend to upgrade to 4G smartphone in the next 12 months and 89 percent will upgrade to VoLTE-enabled phones for unlimited voice service.

Call drops are not a major issue, with 15 percent complaining about it. Bigger issues for mobile users are slow data speeds (as per 25 percent) and a no value for money proposition (as per 36 percent).

39 percent of consumers have tried Jio’s free offering, with 27 percent happy with the service (70 percent of actual Jio users) and rating the service better than their existing operator and the remainder believing Jio is at par or inferior to their existing operator.

There is increased interest to using more data if tariffs become cheaper / network quality improves, implying elasticity on data will likely play out. Sixty percent intends to watch more video and 32 percent will surf more if data tariffs decline.

About 75 percent of these consumers have monthly bills of Rs 250 or more (vs. avg. ARPU of Bharti / Idea of less than Rs 200), and hence we consider most of them to be a target segment for Jio.

Conclusions

As 94 percent of users are largely satisfied with their incumbent SIM, BAML believes the top telecoms will try to prevent their interested users from shifting their primary SIM to Jio by offering freebies / matching tariffs. This would likely lead to higher competitive pressure as Jio tries to poach these subs.

Aircel / Reliance Communications are the most vulnerable, as 33 percent/28 percent of their subs are willing to shift to Jio as their primary SIM.

Data revenues may increase if users upgrade their phones to 3G / 4G smartphones. Jio has higher potential to become a secondary SIM / MiFi for a larger user base (67 percent) and in the process may drive consolidation of smaller telecoms.

The unlimited voice disruption threat remains, with 89 percent of users keen to upgrade to VoLTE-enabled phones. Jio’s network quality and robustness are key to this.

The report said top 3 telecoms will have to spend more on 4G networks.

The survey indicates that Bharti customers were least interested in using Jio as a primary SIM.

21 percent of Bharti users may use Jio as a primary SIM if quality is good vs. 33 percent/28 percent for Aircel / RCOM.

Bharti users were most satisfied with their operator at 96 percent vs. Aircel the least at 88 percent.

18 percent of Bharti Airtel users complain of slower data speeds vs. 29 percent / 26 percent of Idea / Vodafone users.

69 percent claiming they would buy a specific 4G smartphone if such a phone would help them to access Jio’s free unlimited voice plan. A further 20 percent of respondents said that they will look to purchase a Jio 4G-supported handset when they replace their existing mobiles. The balance of 11 percent of respondents are not looking to upgrade to a new 4G-enabled smartphone just in order to get Jio’s free voice services.

BAML believes that such a high propensity of customers willing to buy 4G handsets to access Jio services increases the risk of impact on incumbents’ voice revenues subject to Jio voice quality being good.

The research report indicates that achieving substantial revenue from the targeted 100 million 4G subscribers will be a tough task for Mukesh Ambani’s Jio and team.