Maxis has another disappointing quarter as the telecom operator in Malaysia reported quarter-on-quarter drop in service revenue in Q2 2019.

Q2 service revenue of Maxis fell 1.5 percent to RM 1,918 million reflecting 2.8 percent dip in post-paid revenue at RM 972 million and 0.8 percent drop in pre-paid revenue at RM 791 million during the June quarter of 2019.

Opensignal in its mobile network experience report released in April 2019 said Maxis again led in download speed with an average score of 17.9 Mbps in Malaysia. Celcom has managed to beat Maxis in upload speed with an average speed of 6.3 Mbps.

The report said Celcom is the leading mobile operator in terms of 4G availability with score of 86.8 percent.

But Maxis could not improve in the number of both post-paid and pre-paid customers during the quarter.

Maxis said its post-paid customer base, who pays for mobile services on monthly basis, dropped to 2.875 million in June quarter of 2019 as compared with 2.940 million in March 2019, 3.008 million in December 2018 and 3.104 million in September 2018.

The post-paid ARPU of Maxis dropped to RM 95 in Q2 2019 as compared with RM 96 in March 2019, RM 92 in December 2018 and RM 91 in September 2018.

The pre-paid customer base of Maxis increased to 6.639 million as compared with 6.610 million in March 2019, 6.467 million in December 2018 and 6.417 million in September 2018.

The pre-paid ARPU of Maxis reached RM 42 in the second quarter of 2019 as compared with RM 42 in March 2019, RM 40 in December 2018 and RM 41 in September 2018.

Maxis has added 30,000 fiber broadband connections taking the total number of fiber Internet subscriber to 310,000 in Malaysia.

Maxis has reported home fiber revenue of RM 86 million (+7.5 percent) reflecting an ARPU of RM 106 from home fiber subscribers. Maxis fiber broadband offer superfast speeds –300Mbps, 500Mbps and 800Mbps, for both consumer and businesses.

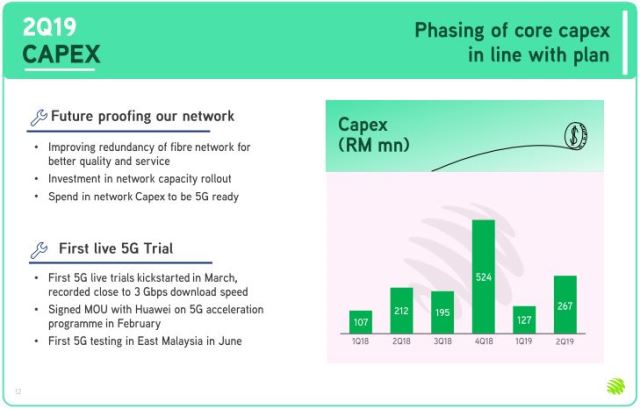

Maxis has increased its quarterly capital expenditure (Capex) during the second quarter to RM 267 million as compared with RM 127 million in March 2019 and RM 524 million in December 2018 and RM 195 million in September 2018.

Maxis has focussed on adding 5G-ready network capacity as part of the Capex programs for the year. Maxis is aiming to spend RM 1 billion towards Capex during the year. This is part of the strategy to reduce Capex.

Maxis, which has selected China’s Huawei as its 5G equipment supplier, has achieved 3Gbps download speed during 5G trials in East Malaysia in June.

Maxis CEO Gokhan Ogut said: “This quarter saw us making headway in our converged ambitions with the launch of new fibre speeds, delivering smart solutions for enterprises and championing Industry 4.0 initiatives in line with the government’s digital economy agenda. The potential of 5G in a future of smart solutions is tremendous.”

Maxis has launched Malaysia’s first commercial NB-IoT service in key IoT market centres and partnered with MDEC to promote the development of the local IoT ecosystem.

Baburajan K