VEON has revealed the telecom operator’s Capex in Russia, Pakistan, Ukraine, Kazakhstan, Algeria, Bangladesh and Uzbekistan during the second quarter of 2021.

VEON’s Q2 Capex reached $297 million in Russia, $505 million in Pakistan, $89 million in Ukraine, $53 million in Kazakhstan, $24 million in Algeria, $18 million in Bangladesh and $16 million in Uzbekistan during the second quarter of 2021.

VEON’s Q2 Capex reached $297 million in Russia, $505 million in Pakistan, $89 million in Ukraine, $53 million in Kazakhstan, $24 million in Algeria, $18 million in Bangladesh and $16 million in Uzbekistan during the second quarter of 2021.

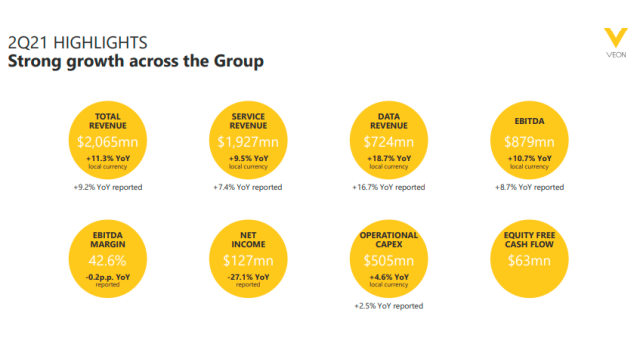

Operational capex of VEON was $505 million in 2Q21, marginally up from $492 million in 2Q20, mainly due to VEON’s continued focus on its 4G network investment program. Capex intensity for last twelve months was 24.3 percent.

The combined 4G population coverage of VEON operating companies reached 77 percent, an increase of 10p.p. VEON’s 4G networks reach 77 percent of the 680 million combined population of nine operating markets, compared with 74 percent in 1Q20.

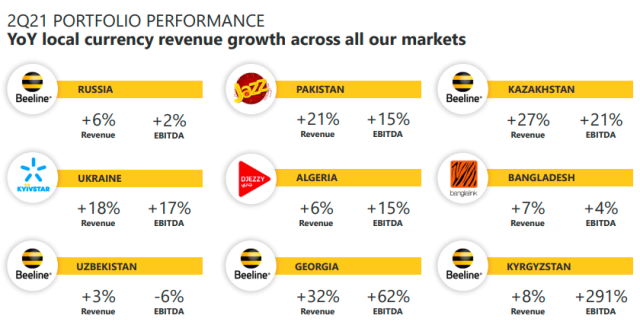

VEON posted revenue of $2,065 million (+9.2 percent) with accelerating revenue growth in Pakistan, Ukraine, Kazakhstan and Bangladesh.

Russia

Russia

Capex excluding licenses and leases (operational capex) increased 22.4 percent in 2Q21. Capex intensity was 29.3 percent, reflecting network investment throughout 2Q21.

Beeline increased its number of 4G sites by 15.3 percent YoY, focusing across all regions to ensure the provision of high-quality infrastructure that is ready to integrate new technologies. In June 2021 Beeline announced a joint project with other telecom operators to clean up spectrum to free frequencies for 5G.

Ukraine

Capex excluding licenses and leases decreased by 6.4 percent and capex intensity was 17.9 percent for 2Q21.

Kyivstar’s strategic focus remained on 4G roll-out during the quarter, driving 4G population coverage of 89 percent. In 2Q21, Kyivstar and Vodafone continued their 4G mobile network sharing arrangement in rural areas and on highways.

Kyivstar played a key role in accelerating the development of the 4G infrastructure by returning to the state its 900 MHz bands to enable the regulator to provide opportunities to invest in new technologies to other operators who face frequency shortages.

In 2Q21, Kyivstar completed a significant IT modernization project by deploying Ericsson’s Digital Business Support System to better serve its customers.

Pakistan

Capex was PKR 13.7 billion in 2Q21, resulting in capex intensity of 20.4 percent versus 20.6 percent in 2Q20. Within this, 4G network investment continued to be the principal focus, the population coverage of which reached 64 percent during the quarter, compared to 56 percent in 2Q20.

Kazakhstan

Capex was KZT 10.2 billion and capex intensity was 21.5 percent. In 2Q21, investments continued to be focused on expanding Beeline’s 4G network in order to satisfy the continued rise in high-speed data demand that characterizes this growth market.

Beeline has in place network sharing with other mobile operators in support of Kazakhstan government’s rural broadband initiative. The initiative is a 3-way agreement that paves way for the nation’s 250+ digital inclusion program. In 2Q21, Beeline covered 337 new settlements (492k total inhabitants) with its network, including 4G coverage.

Banglalink

The number of 4G data users reached 9.9 million following 68 percent YoY growth during the quarter as Banglalink continued to enhance its 4G network in Bangladesh. Banglalink has won Ookla’s fastest network award for the third consecutive term.

The user base of Banglalink’s self-care app increased 93 percent during 2Q21. Banglalink’s video streaming app Toffee gained 1.6 million additional active users during 2Q21, resulting in Toffee’s monthly active users base reaching 5 million with an average watch time 23 minutes increased by 36.9 percent.