Vodafone Idea is facing a significant slow growth in terms of the number of 4G subscriber additions, indicates a report from Citi Research.

Vodafone Idea added 5.4 million 4G customers in the March quarter as compared with 9.5 million in the December quarter and 8.4 million in the September quarter.

Vodafone Idea added 5.4 million 4G customers in the March quarter as compared with 9.5 million in the December quarter and 8.4 million in the September quarter.

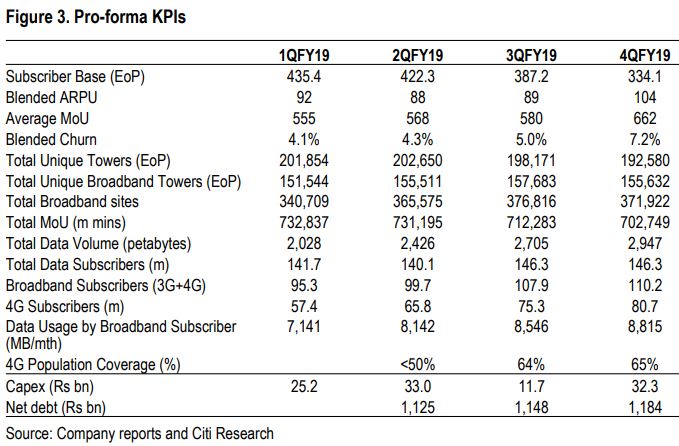

Vodafone Idea’s 4G subscriber-base reached 80.7 million in the March quarter as compared with 75.3 million in the December quarter, 65.8 million in the September quarter and 57.4 million in the June quarter of 2019.

The number of mobile data customers – on 2G, 3G and 4G networks — reached 146.3 million in the March quarter as compared with 146.3 million in the December quarter, 140.1 million in the September quarter and 141.7 million in the June quarter of 2019.

The quarterly Capex of Vodafone Idea has reached INR 32.3 billion in the March quarter as compared with INR 11.7 billion in the December quarter, INR 33 billion in the September quarter and INR 25.2 billion in the June quarter of 2019.

The Capex of Vodafone Idea is significantly low as compared with Bharti Airtel and Reliance Jio though Vodafone Idea has the most number of customers on its 2G, 3G and 4G networks across India.

Vodafone Idea’s FY19 Capex was INR 102 billion as compared with Capex guidance of INR 270 billion. In addition to the 66K site exits already announced at the time of the merger, Vodafone Idea has exited a further 9.9K sites (of the additional 22K exits announced post-merger).

The number of broadband towers of Vodafone Idea reached 155,632 in the March quarter as compared with 157,683 in the December quarter, 155,511 in the September quarter and 151,544 in the June quarter of 2019.

The number of broadband sites of Vodafone Idea touched 371,922 in the March quarter as compared with 376,816 in the December quarter, 365,575 in the September quarter and 340,709 in the June quarter of 2019.

Vodafone Idea’s fourth quarter revenues were flat (+0.1 percent) quarter on quarter after a -7.1 percent/-2.2 percent qoq decline in Q2/Q3.

“Whilst the revenue stabilisation at Vodafone Idea is encouraging, it disappoints when viewed against Bharti Airtel’s +4.3 percent quarter on quarter mobile revenue growth (vs. -2.2 percent/-0.6 percent in Q2/Q3), suggesting a widening of the revenue growth gap between the two operators,” Citi Research said.

EBITDA of Vodafone Idea improved quarter on quarter from INR 11.4 billion to INR 17.9 billion, while margins rose from 10 percent to 15 percent. EBITDA includes INR 12.8 billion of synergy realisation vs INR 7.5 billion in Q3 as well as INR 2 billion of one-offs.

Baburajan K