Telecom regulator TRAI knows that the free voice, 4G data and roaming services by Reliance Jio from September 2016 till March 31, 2017 have started impacting rival mobile operators’ revenue and the growth of the industry.

Telecom regulator TRAI knows that the free voice, 4G data and roaming services by Reliance Jio from September 2016 till March 31, 2017 have started impacting rival mobile operators’ revenue and the growth of the industry.

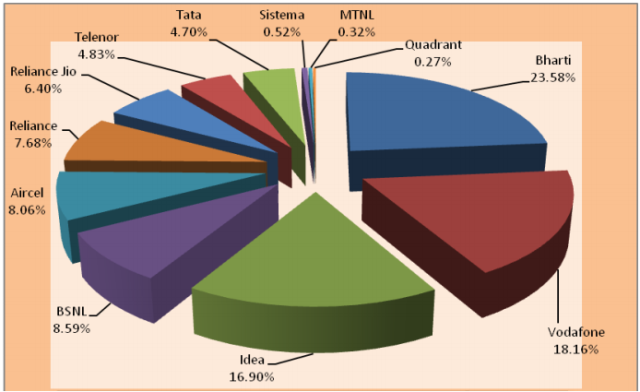

All telecom operators – Bharti Airtel, Reliance Communications, Vodafone India, Aircel, Idea Cellular, MTNL, BSNL and Tata Teleservices are feeling the heat due to the free offers from Reliance Jio. Some of the telecom operators reported decline in revenue and profit in the recent quarters. TDSAT is trying to fix the issue.

TRAI says Reliance Jio Infocomm has 72.16 million broadband subscribers against Bharti Airtel’s 43.56 million, Vodafone India’s 35.02 million, Idea Cellular’s 27.04 million and BSNL’s 20.36 million in December 2016.

India government is currently silent about the predatory telecom pricing by Reliance Jio, a company promoted by Mukesh Ambani. There is no rule to control any Indian telecom operator if they decide to offer free services to its customers.

ALSO READ: TRAI consultation paper on Regulatory Principles of Tariff Assessment

TRAI, through its latest consultation paper issued on Friday, wants to define predatory, promotional pricing, etc. TRAI does not say that it wants to control the free offers from Reliance Jio or any other telecom operator. In fact, TRAI did not mention about Jio. TRAI did not say that it is considering the free offers from Reliance Jio as predatory or promotional in nature.

Though TRAI did not share any question that can get direct answers on the predatory pricing of Jio, mobile operators and other stakeholders have the freedom to express. The main fact that still affects the Indian telecom industry is the strong silence of TRAI in the last five months ever since Jio went live with free offers.

Though TRAI did not share any question that can get direct answers on the predatory pricing of Jio, mobile operators and other stakeholders have the freedom to express. The main fact that still affects the Indian telecom industry is the strong silence of TRAI in the last five months ever since Jio went live with free offers.

The important fact is that TRAI or India government does not want to stop Jio from continuing its pricing because India telecom regulator does not have any strong guidelines to stop such pressing issues.

TRAI notes that offer of bundled services – voice and data – have become the main feature of tariff offerings by the TSPs. Bundled services are offered through composite tariff offer. For examination of a tariff offer with reference to compliance of various regulatory principles, it is essential to assign prices for different components of the bundled services viz. voice, data, SMS, etc. In the current framework, it is not easy to apportion the price of each component of the tariff offers.

However, in the changing ecosystem TRAI believes there is a need to undertake a comprehensive review of the potential anti-competitive practices that could harm the sector and its consumers; set out clearly defined standards of competitive conduct; and explore appropriate regulatory tools to address such concerns. The anti-competitive behavior in the context of tariff setting can be through predatory pricing by the dominant market player.

TRAI wants to discuss the following:

Do you think that the measures prescribed currently are adequate to ensure transparency in the tariff offers made by TSPs? If not, then, what additional measures should be prescribed by the TRAI in this regard?

Whether current definition relating to “nondiscrimination” is adequate? If no, then please suggest additional measures/features to ensure “non-discrimination”.

Which tariff offers should qualify as promotional offers? What should be the features of a promotional offer?

Is there a need to restrict the number of promotional offers that can be launched by a TSP, in a calendar year one after another and/or concurrently?

What should be the different relevant markets – relevant product market & relevant geographic market – in telecom services? Please support your answer with justification.

How to define dominance in these relevant markets? Please suggest the criteria for determination of dominance.

How to assess Significant Market Power (SMP) in each relevant market? What are the relevant factors which should be taken into consideration?

What methods/processes should be applied by the Regulator to assess predatory pricing by a service provider in the relevant market?

The role of TRAI is to ensure the growth of the telecom industry.

Baburajan K

[email protected]