Strategy Analytics today said it estimates that 5G ARPU was 80 percent higher than 4G in Q1 2020.

There were over 75 live commercial 5G networks globally by the start of May 2020. User-linked 5G connections will grow to over 200 million by year-end and 2.8 billion in 2025.

There were over 75 live commercial 5G networks globally by the start of May 2020. User-linked 5G connections will grow to over 200 million by year-end and 2.8 billion in 2025.

“5G momentum will begin to build from 2021, will overtake 4G revenue in 2024, and in 2025 5G will account for 53 percent of service revenue,” Susan Welsh de Grimaldo, director at Strategy Analytics, said.

Wireless service revenue

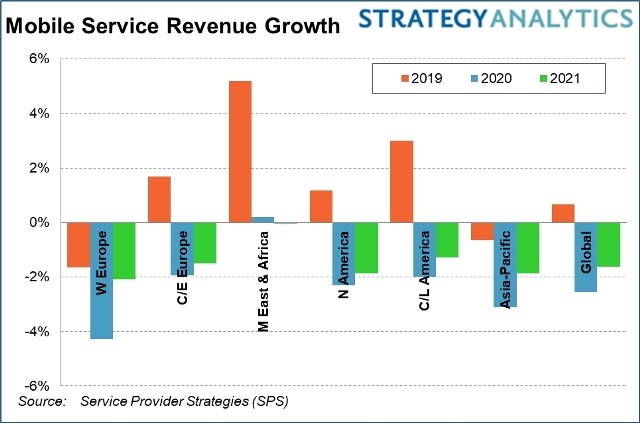

Global wireless service revenue will report 2.6 percent decline in 2020 in the wake of Covid-19 epidemic, according to Strategy Analytics.

“After a turbulent 2020-21, wireless service revenue will begin to stabilize and recover from 2023 as 5G provides a stronger contribution to connectivity revenue. Service provider revenues will continue to decline over the next 5 years,” said Phil Kendall, executive director at Strategy Analytics.

“After a turbulent 2020-21, wireless service revenue will begin to stabilize and recover from 2023 as 5G provides a stronger contribution to connectivity revenue. Service provider revenues will continue to decline over the next 5 years,” said Phil Kendall, executive director at Strategy Analytics.

Significant levels of unemployment or furloughing is impacting disposable income of those impacted. The mobile phone remains a critical tool for most; however affordability is impacting expenditure profiles.

Roaming revenue, which typically accounts for 2-4 percent of service revenue for mobile operators, has been hit significantly and in many regions will run at suppressed levels into 2021 as travel behavior struggles to return to normal.

Broadband connectivity has become a must-have during lockdowns and home working / studying patterns. Many operators are experiencing significant increases in mobile voice and data traffic and the high levels of dependence on mobile phones has seen the wireless sector less impacted than some industries.

Strategy Analytics sees and an increasingly challenging environment for service providers over the next five years.

“Slower overall cellular subscription growth, characterized by fastest growth in lower-ARPU regions and lower-ARPU categories such as connected devices, and sustained competitive intensity will make connectivity service revenue growth hard to find,” David Kerr, SVP Wireless and Broadband, said.