Fitch Ratings has revealed its forecast on telecom operators in the Philippines.

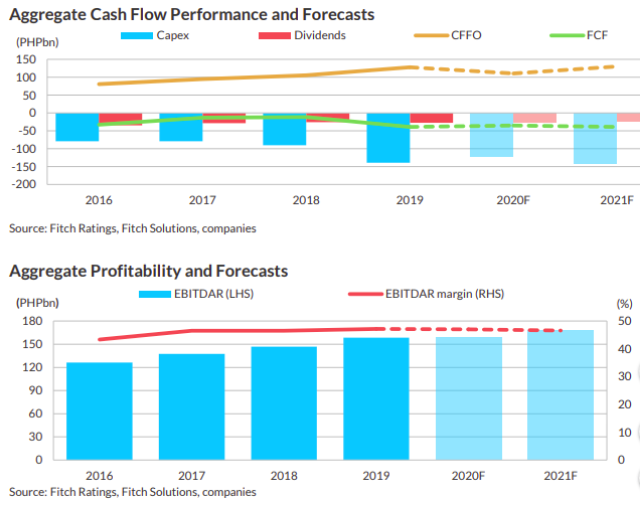

Net leverage for the telecom sector in the Philippines is likely to be steady at around 2.5x-2.6x in 2021 (2020F: 2.5x), as the resumption in EBITDA growth and normalisation of the cash-conversion cycle (from pandemicrelated relief measures in 2020), offset Capex expansion.

Telecom sector revenue growth will be 6 percent- 7 percent (2020F: 1 percent), driven by fast-expanding home broadband services and stable competition in mobile. Deleveraging prospects hinge on a resurgence in mobile revenue and limited Capex aggression.

Regulatory pressure and looming competition are likely to drive Capex higher in 2021, following a deferral in 2020 due to the pandemic restrictions. FCF is likely to stay negative, albeit steady. The Philippines has among the highest capex/revenue ratios in Asia Pacific, at around 40 percent.

The country’s new common-tower policy is also likely to hasten tower builds and access to cell-sites, which are being held up by the lengthy regulatory approval process for permits. There will be stable competition for the next 12 months, despite the impending entry of Dito Telecommunity by March 2021 and the emergence of fixed-broadband provider, NOW Telecom, as the fourth mobile operator.

Competition will intensify in the medium-term as new entrants expand coverage. Dito aims to cover at least 37 percent of the national population over the next six months, while NOW Telecom’s limited spectrum, at 20MHz of 3.5GHz, may imply a niche target market.

Strategic execution will take centre stage amid the challenges posed by the pandemic, as incumbent operators, PLDT and Globe Telecom strive to boost revenue. PLDT’s heavy Capex investments over the past few years and the reallocation of 2G spectrum to 4G have improved network quality and coverage, contributing to increased revenue share since 4Q19 at the expense of Globe.

Telcos will continue to depend on the existing 4G network to meet data demand while pacing 5G investment over the next few years to support cash flow. The extent of 5G rollouts will depend on the affordability of 5G devices, particularly in a prepaid market that yields a monthly ARPU of USD2 for mobile and USD20 for home broadband.

Globe Telecom and PLDT are likely to restrict 5G fixed-wireless access to selected metropolitan areas, says the report from Fitch Ratings.