Telkomsel and XL, two prominent telecom operators in Indonesia, have conducted 5G trials during the recently concluded Asian Games.

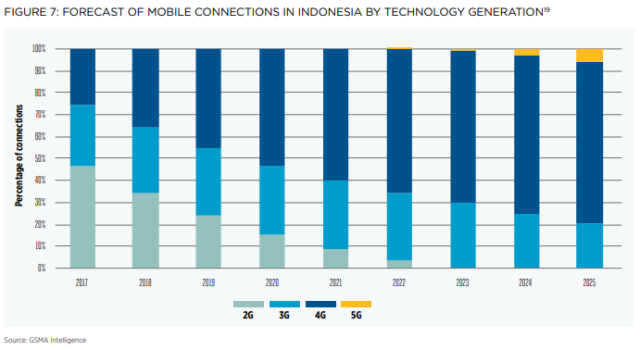

But significant investment in 5G mobile networks in Indonesia is unlikely to happen in the next three-four years, a GSMA report indicates. The chart prepared by GSMA shows that the first round 5G subscriber addition is happening in 2022.

But significant investment in 5G mobile networks in Indonesia is unlikely to happen in the next three-four years, a GSMA report indicates. The chart prepared by GSMA shows that the first round 5G subscriber addition is happening in 2022.

Telecom operators in China, Japan and South Korea are planning commercial deployments of 5G services before the end of 2020. India said it will try to conduct 5G spectrum auction by the end of 2019. GSMA says 5G mobile technology is likely to be at a nascent stage in Indonesia five years on.

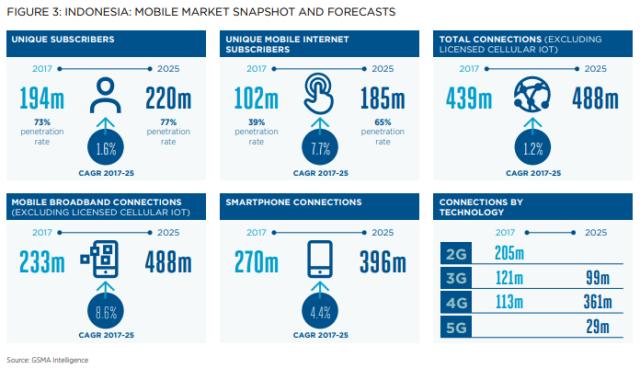

4G LTE is not the dominant technology in Indonesia, and GSMA analysts expect that the 3G lifecycle will not reach maturity for several years. 4G will rise to 2025, accounting for an estimated 361 million connections or 74 percent of total connections.

Indonesia is currently in a transitional phase away from a basic voice and SMS-based mobile market towards a more advanced digital society. The country consists overwhelmingly of prepaid subscribers, reflected in a monthly ARPU of $1.52 or IDR21,900 – well below the global and regional averages.

2G and 3G combined represented 69 percent of total connections. 4G market in Indonesia is growing driven by network investment and spectrum refarming by operators locked in fierce competition, and by a growing consumer appetite for higher speed mobile services.

2G and 3G combined represented 69 percent of total connections. 4G market in Indonesia is growing driven by network investment and spectrum refarming by operators locked in fierce competition, and by a growing consumer appetite for higher speed mobile services.

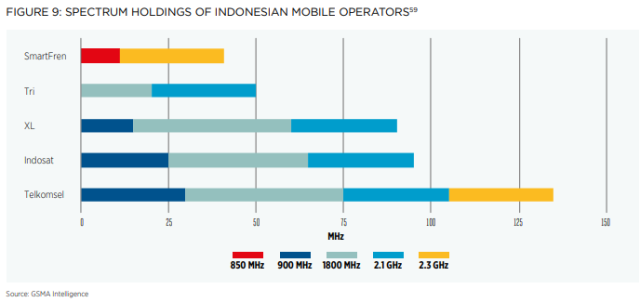

Mobile operators in Indonesia are using 1800 MHz and 2.1 GHz spectrum for deploying 3G and 4G in urban areas. Operators are relying on 850 and 900 MHz frequencies, which are already used for 2G services, to provide mobile broadband in rural areas. Some Indonesian operators have used these bands to increase the reach of mobile broadband to almost 90 percent of the country.

More sub-1 GHz spectrum is needed to continue serving rural areas effectively. Allocation of the spectrum in the 700 MHz band will be important for the mobile Internet operators in the country, GSMA says.

More sub-1 GHz spectrum is needed to continue serving rural areas effectively. Allocation of the spectrum in the 700 MHz band will be important for the mobile Internet operators in the country, GSMA says.

South Korea in April 2018 announced that the current infrastructure sharing regulation in place for fixed networks will be extended to mobile and will see operators participate in the co-deployment of infrastructure, including base stations.

The South Korea government’s action aims to accelerate 5G commercialisation while reducing rollout costs: the potential Capex savings are estimated at KRW1 trillion or $923 million over the next 10 years.

Baburajan K