AT&T CFO John Stephens has revealed the company’s financial targets including 5G Capex and 5G revenue streams for 2019.

John Stephens said at the 2019 Global TMT West Conference in Las Vegas that AT&T aims capital investment (Capex) of nearly $23 billion in 2019.

John Stephens said at the 2019 Global TMT West Conference in Las Vegas that AT&T aims capital investment (Capex) of nearly $23 billion in 2019.

AT&T said it is not expecting any increase in Capex though it started making investment in 5G networks.

John Stephens said 5G will eventually represent a significant revenue stream for AT&T. 5G will not be a significant revenue stream in 2019. “The company expects 5G investment to be managed within current capital intensity levels” John Stephens said.

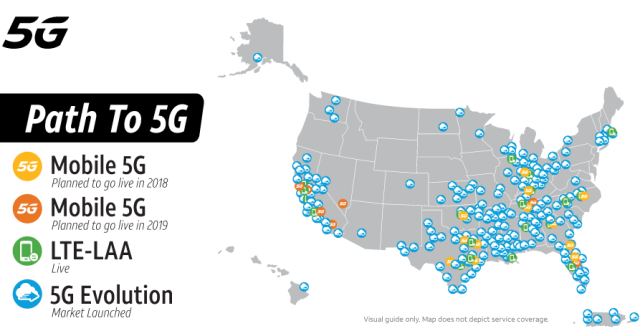

AT&T said 5G network speeds have grown substantially than LTE and with ultra-low latency. 5G use cases for AT&T 5G will be IoT, manufacturing, gaming, augmented and virtual reality, among others.

AT&T expects wireless service revenue to grow in 2019 as well.

The free cash flow will be in the $26 billion range with approximately $12 billion remaining after dividends. The company aims to use $12 billion — as well as $6-$8 billion it expects to raise from asset monetization — to reduce debt.

The company plans to lower its net-debt-to-adjusted EBITDA ratio to the 2.5x range by the end of 2019 and to continue deleveraging through 2022. The vast majority of AT&T’s debt is fixed rate, protecting the company against interest rate increases.

Stephens said AT&T will be able to keep EBITDA levels in its Entertainment Group stable in 2019 as the company focuses on cost controls, profitability and retaining customers with offers.

EBITDA support will come from improving video ARPU as promotional pricing expires for about 2 million linear video subscribers and as annual price increases help offset content cost increases.

The company will focus on enhancing profitability in its over-the-top (OTT) offerings. AT&T does not have DIRECTV NOW subscribers on $10 per month promotional pricing plan now as compared with about 500,000 DIRECTV NOW subscribers at the end of the second quarter last year. The expansion of its cloud DVR offer for DIRECTV NOW will support ARPU growth in 2019.

AT&T also expects growth in broadband revenues in 2019 driven by customer additions and ARPU increases as it expands its fiber network. AT&T expects to cover 14 million customer locations, a nearly 30 percent increase from the end of 2018, by mid-2019.