American telecom operator AT&T is set to increase its Capex in 2019 as it strengthens focus on fiber network and 5G this year.

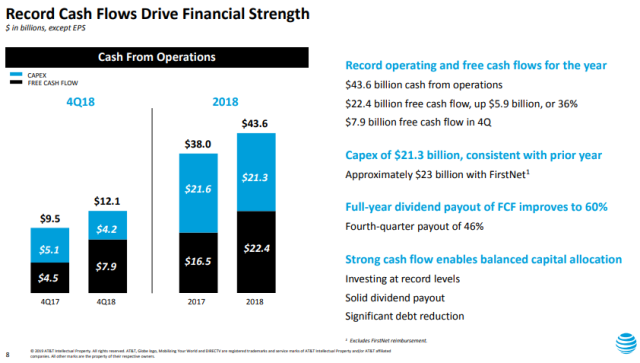

AT&T announced that its capital spending will be nearly $23 billion in 2019 as compared with $21.3 billion in 2018 and $21.6 billion in 2017.

Capital investment in 2018 included about $1.2 billion in FirstNet capital costs and $1.4 billion in FirstNet capital reimbursements, AT&T said.

Verizon on Tuesday said its capital spending will be marginally higher in 2019 due to its investment in fiber network and 5G technology.

AT&T CEO Randall Stephenson said: “This momentum will carry us into 2019 allowing us to continue reducing our debt while investing in the business.”

The main focus of AT&T CFO John Stephens is to reduce debt further in 2019.

AT&T reported revenue of $48 billion (+15.2 percent) in the fourth quarter, primarily due to the Time Warner acquisition.

AT&T reported revenue of $48 billion (+15.2 percent) in the fourth quarter, primarily due to the Time Warner acquisition.

AT&T generated revenue of $19.1 billion from mobility business, $12.2 billion from entertainment business and $7.1 billion from wireline business in Q4.

AT&T’s operating expenses (Opex) have increased to $41.8 billion versus $40.4 billion in the year-ago quarter, primarily due to the Time Warner acquisition.

AT&T has reported operating income of $6.2 billion versus $1.3 billion, mainly due to the Time Warner acquisition and the write-off of network assets in the prior year. Operating income margin rose to 12.8 percent from 3.1 percent.

AT&T posted net income of $4.9 billion, or $0.66 per diluted share, versus $19 billion, or $3.08 per diluted share, in the year-ago quarter.

AT&T’s total revenue rose 6.4 percent to $170.8 billion in 2018 from $160.5 billion in 2017, primarily due to the Time Warner acquisition.

The second-largest U.S. wireless carrier by subscribers gained 134,000 phone subscribers who pay a monthly bill in Q4.

AT&T lost 403,000 satellite television subscribers, versus 147,000 in the prior-year quarter, as viewers continue to cut pricey TV packages in favor of cheaper streaming video services like Netflix and Hulu.

Baburajan K