China Mobile has revealed that it will lower its capital expenditure (Capex) to RMB 183.2 billion for 2023 vs RMB 183.2 billion in 2022 vs RMB 183.6 billion in 2021.

China Mobile said it will allocate RMB 102.9 billion for connectivity in 2023 vs RMB 117.1 billion in 2022. China Mobile’s Capex for expanding 5G network will be RMB 83 billion in 2023 vs RMB 96 billion in 2022. China Mobile’s Capex for computing will be RMB 45.2 billion in 2023 vs RMB 33.5 billion in 2022.

China Mobile said it will allocate RMB 102.9 billion for connectivity in 2023 vs RMB 117.1 billion in 2022. China Mobile’s Capex for expanding 5G network will be RMB 83 billion in 2023 vs RMB 96 billion in 2022. China Mobile’s Capex for computing will be RMB 45.2 billion in 2023 vs RMB 33.5 billion in 2022.

China Mobile, in collaboration with China Broadcasting Network Corporation, coordinated its 700MHz, 2.6GHz and 4.9GHz frequency resources with a scientific approach, and focused on building the base network on the 700MHz frequency band, constructing the 2.6GHz and 4.9GHz frequency bands for indoor coverage.

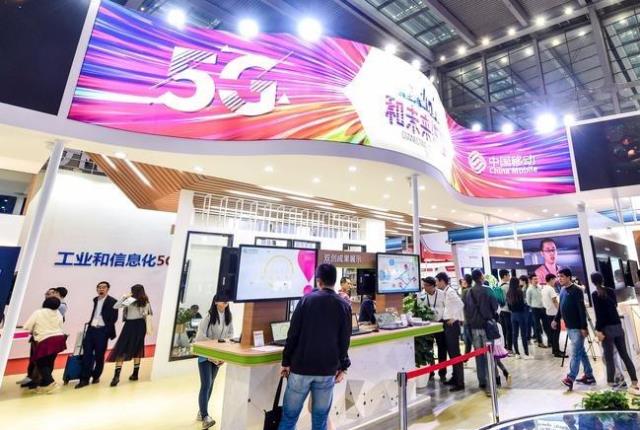

China Mobile, which is establishing the world’s largest 5G standalone (SA) network, has 1.285 million 5G base stations, including 480,000 700MHz 5G base stations. The world’s largest telecom operator aims to have 1.645 million 5G base stations at the end of 2023 by adding 360,000 new base stations in China.

Yang Jie, Chairman of China Mobile, said, in its earnings report: “We systematically built out new information infrastructure centering around 5G, computing force network (CFN) and capability middle platform, and created a new information services system that is equipped with connectivity, computing force and capability.”

China Mobile’s operating revenue reached RMB937.3 billion (+10.5 percent) in 2022. Telecom services revenue of China Mobile rose 8.1 percent to RMB812.1 billion.

China Mobile’s mobile customers totaled 975 million, with a three-year-high addition of 18.11 million customers. China Mobile has 614 million 5G package customers, with a net addition of 227 million in 2022.

The number of customers using 5G voice over high definition video reached 91.90 million, a net addition of 26.82 million customers. 5G digital products, including cloud XR (augmented reality), cloud games and 5G ultra high-definition video connecting tones, started to make value contribution.

Thanks to the migration to 5G and increased customer digital consumption, mobile ARPU (average revenue per user per month) rose 0.4 percent to RMB49. China Mobile’s ARPU from 5G alone was RMB81.5.

China Mobile’s broadband revenue rose 16 percent to RMB116.6 billion. China Mobile has added 25.78 million household broadband customers to reach 244 million in 2022.

China Mobile’s Gigabit broadband customer base reached 38.33 million. China Mobile’s mobile HD customer base reached 193 million. Household customer blended ARPU increased by 5.8 percent to RMB42.1. China Mobile aims to have Gigabit broadband customer coverage of 100 million at the end of 2023.

China Mobile’s Business market revenue rose 22.6 percent to RMB168.2 billion. China Mobile added 4.37 million corporate customers to reach 23.20 million.

Baburajan Kizhakedath