The Ericsson Mobility Report | November 2020 has revealed the forecast on 5G subscriptions in India for 2026.

India

India

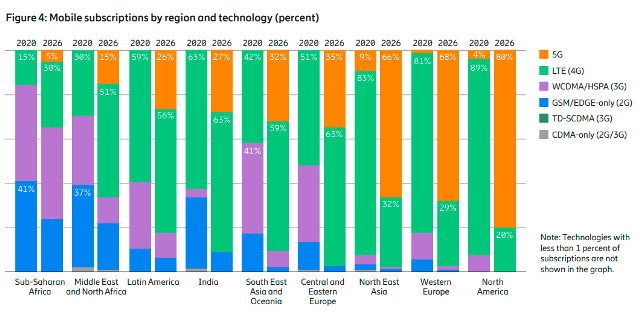

In the India region, LTE subscriptions are forecast to increase from 710 million in 2020 to 820 million in 2026, increasing at a compound annual growth rate (CAGR) of 2 percent. LTE remains the dominant technology in 2020, accounting for 63 percent of mobile subscriptions.

The LTE technology will continue to be dominant, representing 63 percent of mobile subscriptions also in 2026, with 3G being phased out by that time.

5G will represent around 27 percent of mobile subscriptions in India at the end of 2026, estimated at about 350 million subscriptions.

Mobile broadband technologies accounted for 67 percent of mobile subscriptions in 2020, and this figure is predicted to reach 91 percent by 2026, when the total number of mobile broadband subscriptions is set to reach close to 1.2 billion. The number of smartphone subscriptions has increased to 760 million in 2020 and is expected to grow at a CAGR of 7 percent, reaching close to 1.2 billion by 2026.

Sub-Saharan Africa

In Sub-Saharan Africa, mobile subscriptions will continue to grow over the forecast period as mobile penetration, at 84 percent, is less than the global average. LTE is estimated to account for around 15 percent of subscriptions by the end of 2020. Over the forecast period mobile broadband1 subscriptions are predicted to increase, reaching 76 percent of mobile subscriptions.

While 5G and LTE subscriptions will continue to grow over the next 6 years, HSPA will remain the dominant technology with a share of over 40 percent in 2026. Driving factors behind the growth of mobile broadband subscriptions include a young, growing population with increasing digital skills and more affordable smartphones. Over the forecast period, discernible volumes of 5G subscriptions are expected from 2022, reaching 5 percent in 2026.

Middle East and North Africa

In the Middle East and North Africa region, around 30 percent of mobile subscriptions are estimated to be for LTE at the end of 2020. The region is anticipated to evolve over the forecast period, and by 2026, almost 80 percent of subscriptions are expected to be for mobile broadband, with LTE as the dominant technology with more than 50 percent of the subscriptions.

Commercial 5G deployments with leading service providers have taken place here during 2019 and 2020 and 5G subscriptions will reach close to 1.4 million by the end of 2020, with most in the Gulf countries. Significant 5G volumes are expected in 2021 and the region is likely to reach around 130 million 5G subscriptions in 2026, representing around 15 percent of total mobile subscriptions.

Latin America

In Latin America, LTE remains the dominant radio access technology during the forecast period, accounting for 59 percent of subscriptions at the end of 2020 and a predicted 56 percent in 2026. A steady decline in WCDMA/HSPA is forecast as users migrate to LTE and 5G, falling from 30 to 11 percent. To date, Brazil and Colombia have launched commercial 5G services, and other countries such as Argentina, Chile and Mexico are investing in and deploying 5G. By the end of 2026, 5G is set to make up 26 percent of mobile subscriptions.

South East Asia and Oceania

The second half of the year has seen a number of commercial 5G launches in South East Asia and Oceania with live networks now in Australia, New Zealand, Thailand, Singapore and the Philippines. Upcoming spectrum auctions planned for 2021 in countries like Vietnam and Malaysia will bring additional 5G deployments next year.

Though current commercial 5G networks in the region have mostly been deployed on mid-bands, market interest for high-band spectrum has driven successful trials for mmWave in Australia showcasing groundbreaking speeds.

Dynamic spectrum sharing has also been deployed in several countries in the region, enabling mobile operators to quickly increase their 5G footprint as rollouts continue. In addition to mobile broadband deployments, fixed wireless access (FWA) adoption is growing strong with live 5G networks already launched in Australia and the Philippines.

In 2026, 5G is predicted to be the second most popular technology in the region, only behind LTE, surpassing 380 million subscriptions and accounting for more than 30 percent of all mobile subscriptions. 80 percent 5G will account for 80 percent of North American mobile subscriptions in 2026.

Central and Eastern Europe

In Central and Eastern Europe, LTE is the dominant technology and now accounts for 51 percent of all subscriptions. To date, more than 10 5G networks have been commercially launched across the region. In 2026, LTE will remain the dominant technology and is expected to account for 63 percent of mobile subscriptions, while 5G subscriptions are forecast to make up 35 percent.

During the forecast period, there will continue to be a significant decline in WCDMA/HSPA, from 36 percent to virtually zero, as users migrate to LTE and 5G. Further spectrum auctions in the key frequency bands like 700MHz, 3.4–3.8GHz and 4.7GHz were planned for the end of 2020 and the beginning of 2021, some of which have now been delayed. This will have a short-term impact on 5G deployment in affected countries.

North East Asia

In North East Asia, 5G deployment has been accelerating during 2020 and all major service providers in the region have now launched 5G commercial services. In South Korea, 5G network coverage continues to improve, with the goal of nationwide coverage in 2021.

In China, the top 3 service providers are building out large-scale 5G coverage, and the country is estimated to reach 175 million 5G subscriptions by the end of 2020.

The leading service providers in Japan have launched commercial 5G services, but expected 5G subscription uptake has remained low, impacted by the postponement of the Tokyo summer sport event, as well as COVID-19. However, service providers in Japan are now accelerating 5G deployments, as well as dynamic spectrum sharing, and the number of subscriptions is expected to grow significantly with the increased availability of 5G-capable devices.

By the end of 2020 the region is anticipated to have more than 190 million 5G subscriptions, and at the close of the forecast period, the 5G subscription penetration is projected to reach 66 percent.

Western Europe

In Western Europe, LTE is the dominant access technology, accounting for 81 percent of subscriptions. LTE is predicted to decline to 29 percent and WCDMA/HSPA to only 2 percent of subscriptions in 2026 as subscribers migrate to 5G.

Around 35 service providers have launched 5G services across the region, delivering services to around 6.5 million subscribers by the end of 2020. Further spectrum auctions in the 700MHz and 3.4–3.8GHz bands were planned during 2020, but some have now been delayed, which will have a short-term impact on the deployment and coverage of 5G in the region. The 5G subscription penetration is projected to reach 68 percent by the end of 2026.

North America

In North America, 5G commercialization is moving at a rapid pace. Service providers have already launched commercial 5G services, focused on mobile broadband. The introduction of 5G smartphones supporting all three spectrum bands will make 2021 an eventful year for early 5G adopters.

FWA will play a key role in closing the digital divide where the pandemic has exposed large gaps for education, remote working and small businesses. By 2026, more than 340 million 5G subscriptions are anticipated in the region, accounting for 80 percent of mobile subscriptions.