Fitch Ratings on Monday revealed financial stauts of Indonesia Telecoms – Sector Outlook.

Telecom sector leverage may increase towards 2.0x in 2021 (2020F: 1.7x) amid rising network investment to meet demand in mobile data and fibre broadband services.

Telecom sector leverage may increase towards 2.0x in 2021 (2020F: 1.7x) amid rising network investment to meet demand in mobile data and fibre broadband services.

PT Telekomunikasi Indonesia, PT XL Axiata and Indosat will have sufficient leverage headroom to absorb the Capex burden.

Telcos in Indonesia may also raise funds through the sale of non-core assets and tower rentals may be reduced on contract renewal, strengthening deleveraging capacity.

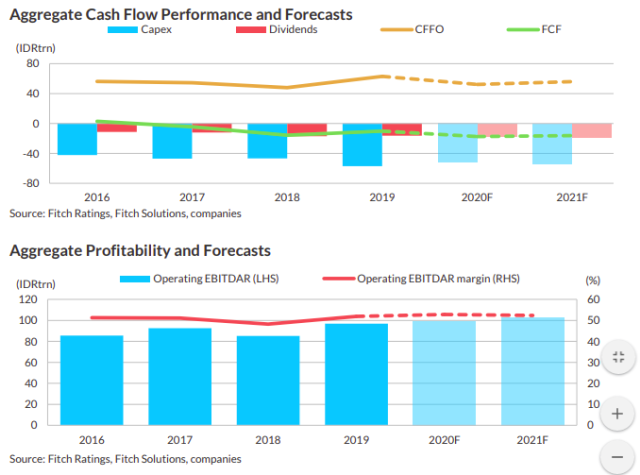

Negative FCF will persist into 2022 due to large Capex investments. Average capex / revenue (excluding spectrum) in 2021 is likely to remain high at around 27 percent-28 percent (2019: 31 percent), driven by capacity expansion and fixed-line fibre infrastructure.

Strong demand for 2.3GHz spectrum in the upcoming auction may heighten investments. XL and Indosat are funding network expansion and fiberisation efforts through other means, such as finance leases.

Strategy execution will be paramount amid a slowing economy, as operators strive to boost revenue, which we forecast to rise by mid-single-digits in 2021, from low-single-digits in 2020 (2019: 6 percent).

The effects of the pandemic were subdued for Indonesia’s mobile market in 1H20 relative to the Philippines and Thailand, though a prolonged economic slowdown could temper prospects.

Competition will persist, as mobile operators continue to adopt tactical pricing strategies in certain clusters, depending on operators’ available network capacity and subscribers’ ability to pay.

However, larger data bundle offerings at incremental prices should also raise blended average revenue per user (ARPU). Indonesia’s three largest telcos all intend to pursue profitable growth.

5G rollout by smaller rivals will prove difficult without scale efficiencies to drive investment feasibility. Indonesia’s new omnibus law – whose final draft is still underway – permits spectrum-sharing of new technology, which should benefit smaller telcos.

Telkom is expected to retain its market dominance and strong network leadership, as extensive fibre infrastructure becomes an important element of the country’s eventual 5G rollout.

Indonesia Telecom Towers

We forecast stable average FFO net leverage, at 4.0x–4.2x in 2021 (2020F: around 4.2x), for Indonesia’s top-two tower companies – TBI and Protelindo. TBI’s FFO net leverage could improve towards Fitch’s positive guidance of 4.75x in the absence of new tower deals and lower shareholder returns in 2020.

Protelindo’s net leverage will improve to 2.8x-2.9x (2020F: 2.9×3.0x). Shareholder returns and M&A continue to drive leverage profiles, as capex is largely demand-driven and backed by long-term non-cancellable tenancy contracts.

Our forecast assumes a progressive increase in dividends and share buybacks at TBI but steadier dividends at Protelindo given its conservative shareholder return policy. Cash Flow Generation – FCF Positive Mean FCF is likely to remain stable in 2021, at 7 percent-10 percent (2020F: 10 percent), benefiting from strong CFFO but moderated by slightly higher capex as tower companies renew ground leases and expand tower and fibre infrastructure.

CFFO growth will be backed by high capex intensity at the topthree telcos at 27 percent-28 percent (2019: 31 percent), driven by capacity expansion and fixed-line fibre infrastructure. Sector Fundamentals Rising

Industry revenue is expected to rise by 6 percent-8 percent in 2021 (2020F: 10 percent-15 percent, including acquisitions). A surge in data demand amid the pandemic, which only had a modest impact on tower companies, and a shift towards larger data bundles and unlimited offerings will drive telcos’ demand for tower and fibre infrastructure.

A faster 5G rollout is likely to accelerate tower company expansion; however, we expect 5G roll out to be delayed to 2022. EBITDA margin may decline by 100bp-150bp (2020F: 84 percent-86 percent) due to lower tower rentals for new contracts. However, improving tenancy ratios may partially offset tower rental pressure and keep profitability high.

The tower industry will continue to consolidate around TBI and Protelindo, as telcos may monetise their tower assets to fund capex, while smaller tower companies could exit the industry as they lack financial flexibility and execution capability.