Mobile World Congress (MWC 2019) will discuss about the latest 5G deployments in several countries. But India will be a silent spectator this time as well. India has already missed a huge opportunity in 3G and 4G as well.

India has lost its 5G business opportunity due to the tough competition posed by Reliance Jio, a company owned by India’s richest person Mukesh Ambani. Reliance Jio has grabbed 280 million 4G subscribers till December 2018.

India has lost its 5G business opportunity due to the tough competition posed by Reliance Jio, a company owned by India’s richest person Mukesh Ambani. Reliance Jio has grabbed 280 million 4G subscribers till December 2018.

Reliance Jio’s monthly ARPU is much better as compared with Bharti Airtel and Vodafone Idea because Reliance Jio does not have enough presence in rural, where folks spend less money on phone connectivity.

5G will not make substantial progress in India in the next two years as debt-ridden telecom operators such as Bharti Airtel and Vodafone Idea are not in a position to spend on buying 5G spectrum and network investment.

Several developed countries will be gaining from 5G business because of their existing investment in fiber network. They invested in fiber because they were under pressure from regulators to improve quality of services. Indian telecom regulator TRAI and government’s DoT did not try to understand why Indians are unable to make calls within their homes.

India has about 1.5 million Kms of fiber deployed. However, telecom sites connected through fiber is less than 25 percent. Most of the telecom sites are backhauled using microwave links. India has the world’s largest installed base of microwave links in the traditional bands- 6GHz to 42GHz.

Lack of fiber means slow progress in 5G in India. Operators such as AT&T, Verizon, China Mobile are not making huge investment in 5G for the time being because they rely on 4G and fiber investment.

TRAI whitepaper on 5G

Surprisingly, TRAI chairman RS Sharma has released a whitepaper on 5G today explaining the investment, business opportunities and challenges in the deployment of 5G network across India.

The TRAI whitepaper released ahead of MWC 2019, the largest telecom event, indicates that deployment of 5G network will require substantial investment in the core, radio network and spectrum.

The whitepaper did not say that India is behind in 5G deployment as compared with Europe, the US, China, Korea, Japan, Middle East. It seems India does not even need 5G in the next two-three years. If Indians are happy about limited 4G, why we need 5G?

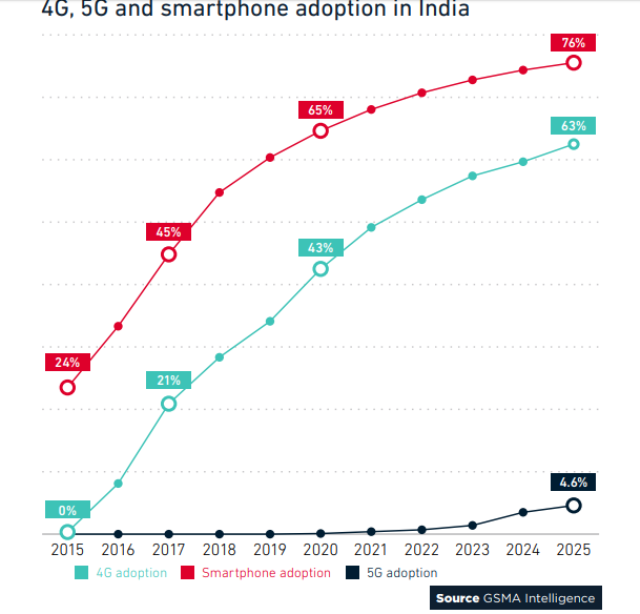

The latest GSMA intelligence report says 5G connections in India will grow to almost 70 million by 2025, equivalent to around 5 percent of total connections (excluding cellular IoT) by that time.

Nokia says India has 432 million 4G subscribers and they drive 92 percent of the data traffic in the country. India’s 4G boom has started after the launch of Reliance Jio in the end of 2016 and its aggressive data plans for India’s youth.

It is a fact that Indian telecom operators are not clear on what they will offer to mobile phone customers after launching 5G. They can offer 5G broadband to homes but they can make only Rs 800 per month from a broadband connection. In some case, broadband ARPU is much less even if you are buying a high-speed connection.

Verizon, a leading operator in the US, is clear that it will add customers from homes with a 5G broadband plan on a fixed wireless network. Verizon will also launch 5G mobile even if Samsung will price the 5G smartphone at $2,000 equivalent to 10 month salary of a common man in India.

Telecom equipment maker Ericsson says 5G enabled digitalization revenue potential in India will be above $27 billion by 2026. This does not indicate that Indian telecom operators will be making huge money from 5G in the initial phase of the launch. Operators need to gear up to sell 5G to enterprises.

A Deloitte report said the industry may require an additional investment of $60-70 billion to implement 5G networks. Ernst & Young has also estimated that India would have to invest $60-70 billion for 5G.

But Indian telecom operators’ annual spend is around $2 billion per year. Bharti Airtel tops in spending.

Nokia says 5G coverage compared to 4G coverage using 1800 MHz spectrum band would be about 60 percent. Operators with existing 5G footprint will be able to leverage 4G UL coverage through concept of dual-connectivity/UL-sharing and hence will be able to cover larger areas with same number of sites. A new 5G operator will need to deploy about 66 percent more sites to compensate for penetration losses.

3.5 GHz spectrum band is likely to be the first band to be globally used for 5G deployment. DoT is yet to auction spectrum in the 3300-3600 MHz bands. This means, Indian telecoms such as Bharti Airtel, BSNL, Vodafone Idea and Reliance Jio need to spend on costly 5G spectrum as well.

Small Cell Forum says the compound annual growth rate in the deployment of small cell will be 14 percent. The global deployment of small cell will reach 11.4 million by 2025, with 8.5 million of those in non-residential.

The marginal cost of small cell equipment is generally lower than deploying a macro base station site. Since large number of small cells will be deployed to provide additional capacity in densely populated areas, the total expenditure would be substantial.

India’s small cell deployment growth would be huge and soon going to outpace global standards. The investment requirement for network densification coupled with the difficulties in site identification and related permissions is likely to lead to increased infrastructure sharing among telecom operators.

International Telecommunication Union (ITU) says investment in fiber backhaul will go beyond $144.2 billion between 2014-2019 globally.

India is not discussing about why Indians will not be getting 5G in the next two years. Indians are getting Tik Tok and WhatsApp and Facebook and YouTube on their cheap and costly phones outside their homes and not inside. And we are not spending much on data plans at present – thanks to huge competition. Despite job losses in telecom sector, and lack of innovation, data-hungry Indians are happy.

Baburajan K