India will kick off the much delayed 5G spectrum auction on July 26, Tuesday. Reliance Jio and Bharti Airtel are hoping to enhance customer experience to 5G smartphone customers.

Reliance Jio, Bharti Airtel, Vodafone Idea and Adani group have submitted a combined Rs 21,400 core in earnest money deposit (EMD).

Reliance Jio, Bharti Airtel, Vodafone Idea and Adani group have submitted a combined Rs 21,400 core in earnest money deposit (EMD).

India is selling spectrum worth Rs 1.9 lakh crore. India is aiming to sell spectrum in the 600 MHz, 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz, 3300 MHz and 26GHz bands during the auction.

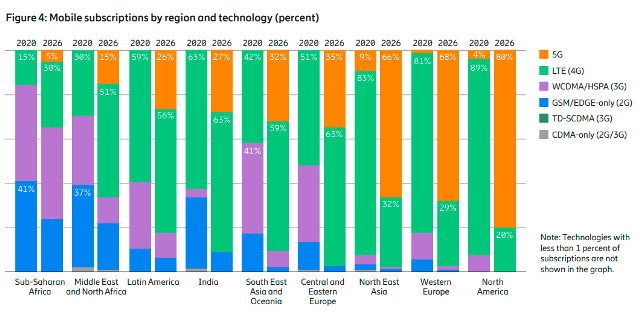

In India, 5G is expected to account for nearly 40 per cent of all subscriptions by 2027. In global terms, 5G is forecast to account for almost half of all subscriptions by 2027, topping 4.4 billion subscriptions as per the latest edition of Ericsson Mobility Report 2022.

“The next 36 hours will pave the way for 5G roll-out in India. While the EMD deposited and subsequent allocation of points allows operators to buy spectrum almost to the tune of Rs. 2 lakh crore, India Government is expected to garner close to 40 percent from this auction,” Peeyush Vaish, Partner and Telecom Sector Leader, Deloitte India, said.

“Operators will bolster their need of sub-1Ghz spectrum apart from the mid and high bands for 5G roll-outs. Since the supply is abundant, there is a fair chance of deferment of larger chunks of spectrum by the operators.”

Reliance Jio has submitted an EMD of Rs 14,000 crore. Bharti Airtel has put in EMD of Rs 5,500 crore.

In the 2021 auctions for 4G spectrum, Reliance Jio used 77.9 percent of their earnest money deposit while Airtel used 87.7 percent.

The 5G auction — entailing 72 GHz of the spectrum – will conclude by July-end or earlier and the rollout is expected by September this year.

Telcos are allowed to surrender spectrum that will be auctioned after a minimum period of 10 years from the date of acquisition.

Last month, the Department of Telecommunications (DoT) has scrapped the 3 per cent floor rate on spectrum usage charge (SUC).

More than half (52 percent) of Indian enterprises want to start using 5G within the next 12 months according to a new study from research consultancy Omdia sponsored by Ericsson. A further 31 percent expect to use 5G by 2024.

The study highlights that quality of experience rather than price drives customers to buy 5G, changing the competitive dynamics of India’s telecoms market. The top 5G use cases that enterprises identify are enhanced content streaming, real-time video analytics and control of autonomous vehicles and drones.

The Omdia study says that telecom service providers in India also need a balanced portfolio of spectrum assets to deliver 5G services that consumers and enterprises will buy. These include low-band spectrum for coverage, mmWave for capacity, and mid band for a mix of both.

The study predicts that 5G rollout will differ profoundly from 4G: 5G offers more service options and use cases. Globally, public 5G and 5G fixed wireless access (FWA) are the most widespread 5G services today among consumers and businesses.