Indian telecom operators have missed a big opportunity to make investment in their fibre networks ahead of their 5G roll outs in 2020-22.

India Government is gearing up to sell 5G spectrum in 2019-2020 though Indian telecoms are not yet ready to buy the costly frequencies.

Indian telecom operators may need to make investment of up to Rs 1 lakh crore or $14 billion for laying fibre networks over the next 2-3 years, according to a report by Crisil.

Land cost and Right of Way (RoW) approvals make the cost for laying fiber per km as high as Rs 1 crore per km in metros.

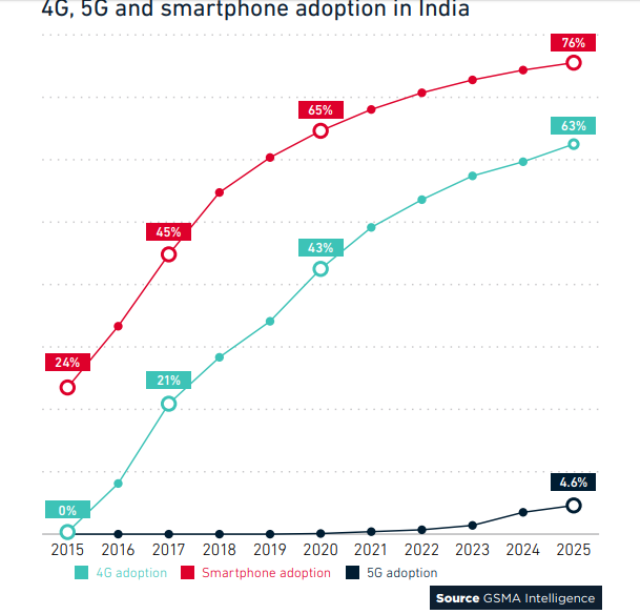

The latest Ericsson Mobility report indicated that Indian telecoms will be making investment in 5G network in a phased manner. This is because telecoms are in the process of expanding their 4G networks at present.

Global telecoms such as AT&T and Verizon in the US and Deutsche Telekom of Germany made significant investment in fibre network ahead of their 5G network roll outs. In fact, these telecom operators did not increase their annual Capex because they have already made investment in fibre networks.

5G technology is forecast by research firm Ovum to achieve 37 million in 2020, 156 million by end of 2021 and more than half a billion in 2022. 5G Americas’ member company Ericsson has forecast that 5G subscriptions are expected to reach 1.9 billion globally in 2024.

The reserve price recommended by the Telecom Regulatory Authority of India (TRAI) for 5G spectrum is much higher than in countries like the UK or South Korea. Indian operators could restrict 5G launch in the initial years to metros and select A circles with high data consumption appetite, Crisil said.

The recent 5G spectrum auctions in Italy and Germany, two leading telecom markets in Europe, fetched nearly $7 billion for respective governments pushing telecoms to debt trap. Indian telecoms have debt of about Rs 4.3-lakh crore as of March 2019.

Fibre investment

The main challenge for Indian telecom operators is the lack of investment in fibre network that can power 5G. 5G require 70 percent fiberisation levels compared with 25-30 percent at present. Investment in fiber backhaul infrastructure, which provides unlimited capacity and higher speeds, has to gain further traction, if 5G has to become reality.

Fiber is expensive and it comes on top of 5G spectrum costs. India is set to witness some shifts in the fiber landscape and the birth of new business models among telecoms and tower companies around the launch of 5G.

New business model

Telecoms are following various business models, such as hiving off of assets, diversification of businesses and sharing them with the third parties, in order to reduce debt.

Divestment of fibre and tower assets into a separate business is one of the business models. It imparts flexibility to the divested entity for providing services to third parties in the industry, and enables the company to pursue revenue growth opportunities. It reduces Capex requirements, de-leverages the balance sheet and leads to higher valuation of entities as cash flows get predictable.

Tower companies are also looking to diversify their business from being merely pure play tower service providers to managed service providers and into areas such as in-building solution (IBS) small cells, fibre backhaul and others.

Indian telecom tower companies have lost core revenue streams such as tower rentals due to tenancy losses due to merger between Vodafone and Idea Cellular and the exit of Aircel, Tata Teleservices and Reliance Communications.

Sale of fiber optic test equipment exceeded 1.2 million units in 2018, and is estimated to register 5.6 percent year on year growth in 2019, according to a new study of Future Market Insights (FMI). The fiber optic test equipment market will record a CAGR of over 6 percent through 2027, in terms of volume.

Baburajan K