AGCOM, Italy’s communications regulator, said the government would conduct spectrum to sell frequencies for 5G mobile services in September, Reuters reported.

The 5G spectrum auction is expected to assist the Italian government to mobilize at least 2.5 billion euros or $2.9 billion from the sale of frequency to telecom operators, AGCOM said in a statement.

Telecom Italia (TIM) has launched 5G in San Marino taking Europe to the top of the wireless space. TIM is the first telecom operator in Europe to create a live 5G network for commercial purposes with Nokia and Qualcomm.

Ofcom, the telecom regulator in the U.K., has already conducted spectrum auction for selling both 4G and 5G frequencies earlier this year.

The Italian Government will package two 80 MHz lots and two 20 lots MHz within the 3600-3800 MHz band, with the forecast of a cap equal to 100 MHz. The regulator said 5G frequencies will be available in bands 694-790 MHz, 3600-3800 MHz and 26.5-27.5 GHz.

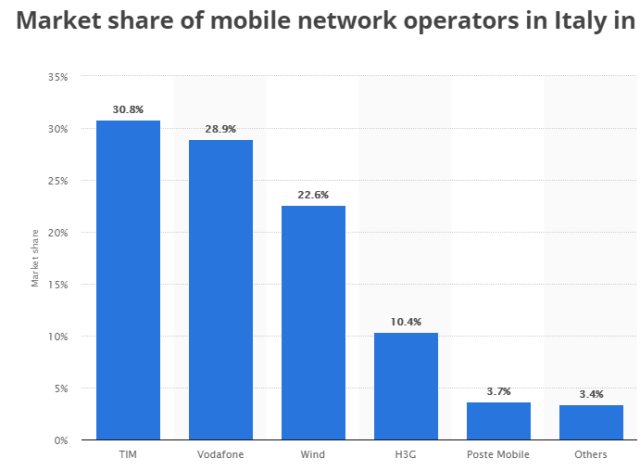

The above chart prepared by Statista shows the wireless market share of main operators in Italy in 2016.

AGCOM said the 5G spectrum rules represent the first step for the roll-out of 5G services, which promises to deliver ultra-fast internet connections to Italian homes and businesses.

Italy, which ranks 25 out of 28 in this year’s Digital economy and society index (Desi) of EU member states, is the first country in Europe to set the rules for assigning frequencies in a 5G auction.

In Germany final auction conditions will be made available by the end of the year and the auction itself is expected to be held early 2019.

Under a 2016 plan, the European Union wants to deploy 5G for all urban areas and major terrestrial roads by 2025.

Italy’s main telecom operators, including Telecom Italia (TIM), Vodafone Italia, Wind-Tre and Fastweb are expected to join the auction.

AGCOM said the rules would help the development of a series of new players including pure infrastructure operators.

Open Fiber, controlled by utility Enel and state lender CDP, is currently building a fiber optic network to offer fast broadband services to telecom operators, in direct competition to TIM.

5G services need fiber optics to work properly since copper networks would not be fast enough to support the next generation mobile phone technology.