Fitch Ratings has revealed the forecast on 5G business of mobile operators in Singapore.

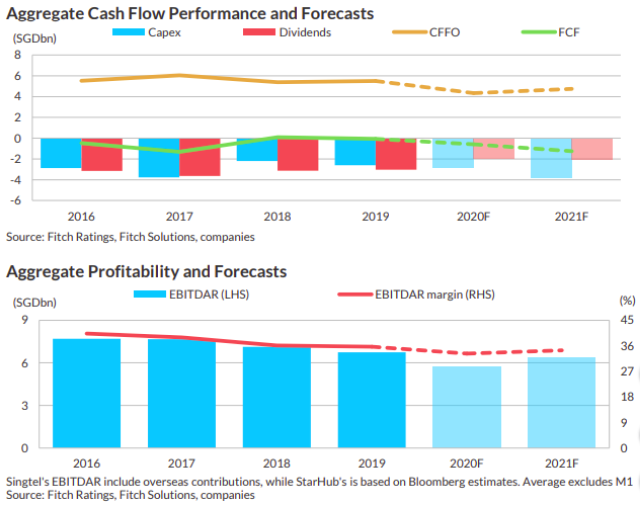

Net leverage for the sector is likely to deteriorate to around 2.5x in 2021 (2020F: 2.0-2.1x) due to continuing tough market conditions and a step up in 5G capex. Capex could increase by 30 percent-35 percent as telcos roll out 5G standalone networks.

Any delay in assigning the 700MHz spectrum would reduce net leverage by around 0.2x. The timing of the SGD846 million spectrum payment will depend on when the frequency band is made available to telcos.

Free cash flow visibility will hinge on the increase in 5G capex, while the lack of compelling use cases is likely to delay the return on investment in the initial years.

Incumbent telcos, Singtel, StarHub Ltd and M1, will manage capital prudently, including shareholder returns, to ease their capex burdens.

Potential monetisation of non-core assets, such as Singtel’s towers in Australia, could also provide financial flexibility.

There will be cost-saving initiatives and resumption of enterprise spending and information and communications technology projects to drive an EBITDA recovery. It is likely to remain below pre-pandemic levels until 2022 in view of weak roaming revenue and continuing data price competition.

Telcos will maintain 5G tariffs at 4G prices to drive subscriber migration at its infancy, given the lack of compelling applications that sufficiently differentiate 5G value from 4G services.

Singapore’s ambition to leapfrog 5G rivals to pursue a standalone network will drive telecoms’ capex, with the 3.5GHz spectrum-band freed up for commercial use in 2021.

StarHub announced its 5G capex guidance of around SGD200 million over a five-year period, and expects to front-load investment in 2021, while staggering the rest across 2022-2025.

Capex burden would be greater for Singtel, although it has not provided guidance.

StarHub and M1, through their 50:50 joint venture, were awarded the country’s second nationwide 5G licence.

5G investment is critical for strengthening the competitiveness of incumbent telcos through product differentiation and network quality, potentially weeding out smaller operators and easing competition in the medium term.

TPG Telecom and mobile virtual network operators are less likely to engage in price competition for 5G, as they depend on incumbent telcos for 5G wholesale services.

TPG Telecom, which ended its free trials in March 2020, will need to substantially improve its network and service quality to compete with rivals.