Reliance Industries (RIL) will pick up controlling stakes in Den Networks and Hathway Cable as part of the broadband strategy of Reliance Jio.

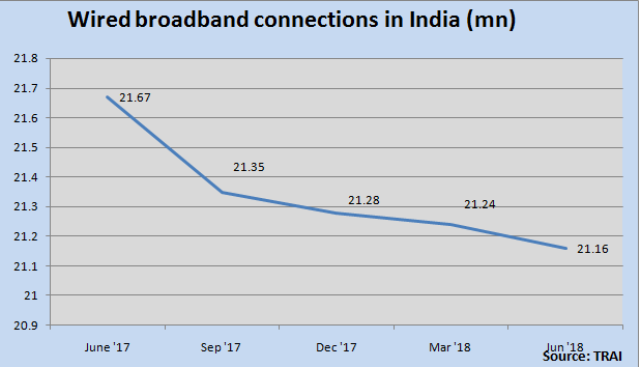

The above chart indicates that de-growth in the Indian fixed broadband market in the last few quarters. The India wired broadband market lost its sheen in the wake of the rapid growth in 4G market.

Reliance Jio has already added more than 250 million subscribers on its all-India 4G network across the country. The investment in broadband and cable market will enable Reliance Jio to enhance its current ARPU of Rs 137 per month from 4G subscribers.

The significant investment in Den Networks and Hathway Cable, two wired broadband operators with strong presence in cable business, will enable Jio to bring JioGigaFiber to more than 50 million homes across 1,100 Indian cities and towns.

This is the first major investment in a broadband-cum-cable operator by a telecom service provider in India. Earlier, Vodafone Group acquired You Broadband for an undisclosed amount.

BSNL in crisis?

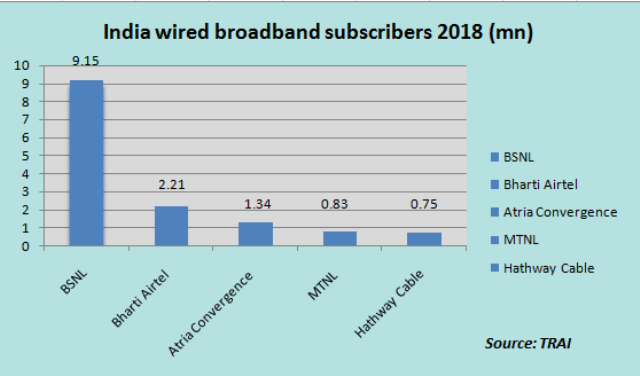

The investment in two broadband operators will enable Reliance Jio to take on BSNL, the largest fixed broadband service provider in India.

The top five wired broadband service providers are BSNL with 9.15 million, Bharti Airtel with 2.21 million, Atria Convergence Technologies with 1.34 million, MTNL with 0.83 million and Hathway Cable & Datacom with 0.75 million customers.

Reliance Jio is already the leading mobile data operator with 227.05 million subscribers as compared with Vodafone Idea’s 107.31 million, Bharti Airtel’s 93.11 million and BSNL’s 11.03 million subscribers.

Reliance Jio is already the leading mobile data operator with 227.05 million subscribers as compared with Vodafone Idea’s 107.31 million, Bharti Airtel’s 93.11 million and BSNL’s 11.03 million subscribers.

Jio has already started work on connecting 50 million homes across 1,100 cities. It will work together with Hathway and Den and all the LCOs to offer a quick and affordable upgrade to JioGigaFiber and Jio smart home solutions to the 24 million existing cable connected homes of these companies across 750 cities.

“We are glad to join hands with Rajan Raheja and Sameer Manchanda, two of the pioneers in the MSO industry. Our investments in DEN and Hathway create a win-win-win outcome for the LCOs, customers, content producers and the eco-system,” Mukesh D Ambani, chairman and managing director of RIL, said.

RIL investment

RIL will make primary investment of Rs 2,045 crore through preferential issue and secondary purchase of Rs 245 crore from the existing promoters for 66 percent stake in Den Networks.

RIL will make primary investment of Rs 2,940 crore through a preferential issue for 51.3 percent stake in Hathway Cable and Datacom. RIL would also make open offers in DEN and Hathway.

India’s LCOs have connected about 175 million homes with coaxial cable technology. LCOs lost 60 million home connections because of competition from alternate technologies like DTH.

Reliance Jio will be strengthening the 27,000 LCOs that are aligned with DEN and Hathway to enable them to participate in the digital transformation of India through access to superior back-end infrastructure.

Baburajan K