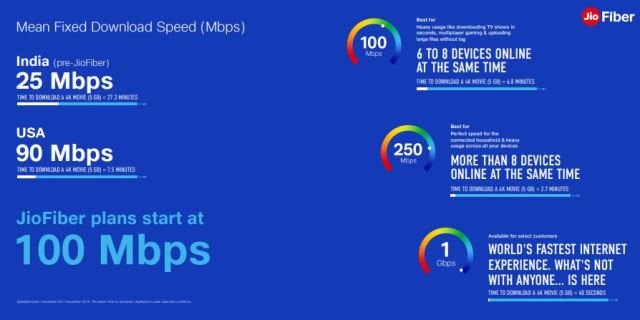

Reliance Jio on Sept 5 launched JioFiber FTTH broadband with plans ranging from Rs 699-8499+taxes per month.

Most of the analysts are indicating that some of the broadband packages from Jio will not be exciting enough to attract customers.

The latest report from Jefferies said Jio broadband pricing is in line with current offerings by rivals such as Airtel, BSNL, among others. Jio can succeed in the broadband space given its reach of 1,600 towns.

The key will be customer support where Hathway and Den last mile can aid. Its target of 20 million homes in 18 million is still aggressive. Jio is expected to spend wisely in broadband roll-outs with changes in price/incentives ahead to achieve its targets, said Jefferies equity analysts Piyush Nahar, Somshankar Sinha and Pratik Chaudhuri.

Jio’s broadband pricing is 12-23 percent lower than Airtel but similar to or even higher than local broadband providers. The speeds offered are higher in low-end plans. Jio is offering OTT apps free for 3-12 months for most plans except the lowest.

India has 18 million home broadband connections and 50 percent of the market is dominated by BSNL / MTNL. Only 7 percent of the connections are fiber. Jio’s reach of 1600 towns and fiber layout of 700K route km rising to 1.1 million going forward is a key positive as it likely will reach most potential customers.

Reliance Jio will face challenges because fixed line has a high service component in terms of providing support in case of issues. Hathway and Den can aid in handling challenges given their existing 14 million cable home connections. Their local support team can provide timely customer support and reduce downtime for JioFiber.

Jio is targeting 20 million homes and 16 million enterprises across 1,600 towns and aims to complete the roll-out in 12-18 months vs Airtel current subs of 2.3 million and 10 million home pass.

Success of Jio broadband will depend on the customer service including support in downtime and other issues, Jefferies said.

A Goldman Sachs report said said Jio will reach 8 million broadband subscribers by fiscal 2023 vs Airtel at 3 million.

The report said some of the broadband plans of Jio will not attract enough customers in the initial phase of the launch.

Free TV may not be a big attraction as Jiofiber subscribers have to make an initial payment of Rs 2,500. Free television on plans starting at Rs 1,299 per month – with minimum upfront commitment of Rs 35,000 including taxes may appeal to a very limited set of consumers, the report said.

Jio’s another offer — free 24-inch television with some plans – will not receive demand because Amazon.in is already selling 24-inch televisions in India at a starting price of Rs 5,000. Jio’s target homes of 20 million are likely to already have an HD or UHD television. Most consumers may not be willing to commit upfront payment of Rs 35,000 amount for home broadband.

Jio will not have more than a few hundred thousand subscribers on a new plan that enables users to watch movies at their homes on the day of release. The main reason for the likely poor demand is the price of the plans — Rs 2,499 per month or Rs 2,950 including taxes.

IIFL said Jio will need to introduce lower priced plans. The appeal for Jio’s TV offering over fibre may be limited since Jio TV is available free of cost on mobile. The First Day First Show movies are for customers on Rs 2499 / month plan and above will not add enough customers to Reliance Jio.