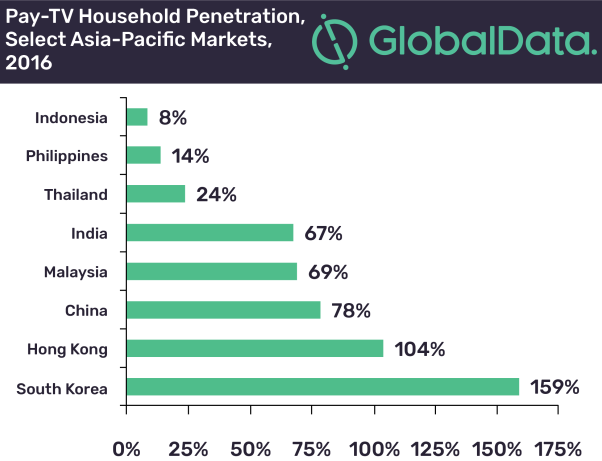

The video on demand (VoD) market is rapidly evolving in India though the country has a low Pay-TV penetration rate of 67 percent in 2016.

For comparison, South Korea leads the Pay-TV market with household penetration rate of 159 percent in Asia Pacific. Hong Kong has 104 percent Pay-TV household penetration rate, commanding the second position.

Both international and domestic over-the-top (OTT) players are driving the VoD market in India, says research firm GlobalData.

Digital video content in India is growing in popularity thanks to influencing factors such as 4G connectivity, broadband reach and digitization.

Early entrants in the VoD space can gain an edge over their competitors in India. Global VoD players such as Netflix, Amazon Prime and YuppTV are making early in-roads with different strategies to capture the Indian market, while domestic players such as Hotstar and Sony Liv are following suit.

“Netflix is contemplating tie-ups with Indian cable operators to integrate Netflix with cable set-top boxes to offer a smart TV-like experience to consumers without smart TVs,” Haseeb Ahmed, technology analyst at GlobalData, said.

Competition is becoming fiercer with a variety of players such as Vu, Xiaomi, Airtel TV and ACT Fibernet vying for a larger pie of the Indian VoD market.

The key strategy of VoD players is to enhance the scope of their digital content by providing regional content alongside international content that suits consumers from metropolitan, tier-1 or tier-2 cities.

Netflix offers VoD at a subscription cost. Amazon’s Prime membership is multi-dimensional, providing a range of digital entertainment services alongside benefits such as free and speedy delivery on retail purchases, giving consumers more reasons to sign up and increasing Amazon’s VoD penetration.