The latest Ofcom report indicates alarming signals for the Pay TV industry in UK as pay TV revenue and subscription dipped in Q1 2018.

The number of UK subscriptions to the three popular online streaming services – Netflix, Amazon Prime and Sky’s Now TV – reached 15.4 million in Q1 2018, overtaking, for the first time, the number of pay TV subscriptions, at 15.1 million.

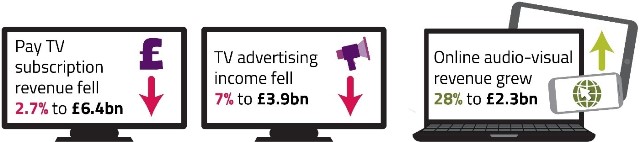

UK’s Pay TV revenue fell 2.7 percent to £6.4 billion in 2017 — for first time. In contrast, the streaming subscriptions contributed to 28 percent growth in online audio-visual revenues to £2.3 billion in 2017.

Television advertising income fell 7 percent to £3.9 billion.

BBC, ITV Channel 4 and Channel 5’s £2.5 billion combined network spending on original UK-made programs in 2017 represents a record low – and is £1 billion (28 percent) less than the 2004 peak of £3.4 billion.

The amount of time spent watching broadcast television on the TV set has dipped in 2017 to an average of 3 hours 22 minutes a day, down nine minutes (4.2 percent) as compared with 2016, and 38 minutes (15.7 percent) since 2012, according to Ofcom’s Media Nations report released on Wednesday.

Ofcom CEO Sharon White said: “We have seen a decline in revenues for pay TV, a fall in spending on new programmes by our public service broadcasters, and the growth of global video streaming giants. These challenges cannot be underestimated.”

Music industry revenues from online streaming subscriptions from Apple Music and Spotify, among others, have exceeded physical sales in 2017.

Retail music sales grew by 6 percent in 2017 driven by 38 percent surge in online streaming service subscriptions to £577 million. Sales of physical music formats fell to £470 million in revenue. There was a 25 percent drop in sales of music downloads reflecting the shift away from music ownership towards streaming.