Netflix has set a revenue target of $4.494 billion from 148.16 million paid video subscribers in the first quarter of 2019 – posing challenges to AT&T and Comcast.

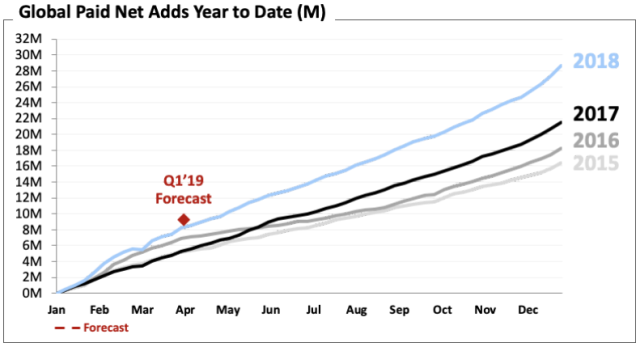

Netflix aims to add 8.9 million new subscribers in the first quarter with 1.6 million in the US and 7.3 million internationally. The target in new subscribers reflects that Netflix will be able to add more growth markets.

Netflix aims to add 8.9 million new subscribers in the first quarter with 1.6 million in the US and 7.3 million internationally. The target in new subscribers reflects that Netflix will be able to add more growth markets.

Netflix said it has added 9 million paying memberships in Q4 2018 and 29 million in the full year, showing the demand for original content.

Telecom operators cannot remove Netflix because it’s one of the foundations for their data business. AT&T and Comcast also have digital offerings in the works. Verizon earlier said it would focus more on building 5G networks across the nation than making investment in adding revenues from entertainment business.

Netflix said it lost more of its customers’ viewing time to the video game Fortnite than HBO, the premium cable network owned by AT&T. Netflix also announced a price increase for U.S. subscribers earlier. Netflix increased prices for new members in Canada and Argentina in Q4, and Japan in Q3.

“The new pricing in the US will be phased in for existing members over Q1 and Q2, which we anticipate will lift ASP,” Netflix said. The price hike will assist Netflix to aim for a 21 percent increase in its total revenue in the first quarter.

Netflix in 2018

Netflix grew annual revenue 35 percent to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Netflix’s average paid memberships rose 26 percent and ASP grew 3 percent.

Netflix earns around 10 percent of television screen time and less than that of mobile screen time in the US.

“When YouTube went down globally for a few minutes in October, our viewing and signups spiked for that time,” Netflix said. “Our focus is not on Disney+, Amazon or others, but on how we can improve our experience for our members.”

It faces competition from TV and movie producers such as Walt Disney, which has stopped supplying new movies to Netflix in order to stock its own streaming service planned for later this year.

Netflix said its programming now accounts for about 10 percent of television screen time in the United States, a sign of its popularity but also the room for growth. Total paid streaming subscribers reached 139 million worldwide.