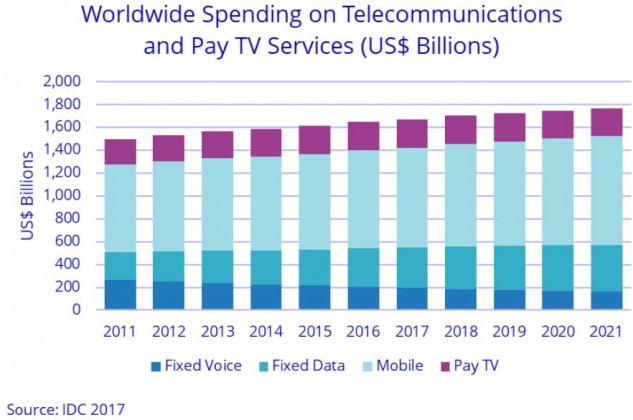

Worldwide spending on telecom and pay TV services is expected to grow 2 percent to surpass $1,700 billion in 2018, IDC predicted earlier.

This is a big development for top telecom operators such as Verizon, AT&T, China Mobile, DT, Orange, Vodafone, Airtel, among others.

The indication on the marginal growth in annual spedning is also a good news for telecom equipment makers such as Ericsson, Huawei, Nokia, ZTE, among others because telecom operators will plan their Capex (capital expenditure) based on their revenue.

The anticipated growth in the global spending on telecom and pay TV services in 2017 was 1.7 percent to reach nearly $1,700 billion.

Mobile represents 52 percent of the total market in 2017. The mobile market is expected to have a compound annual growth rate (CAGR) of 2 percent over the 2017-2021 forecast period, driven by the growth in mobile data usage and M2M applications.

Fixed Data service spending represents 21 percent of the total market in 2017 and that is set to grow by a CAGR of 4 percent driven by the need for higher bandwidth services.

| Global Regional Services 2017 Revenue and Year-Over-Year Growth (revenues in $US billions) | ||

| Global Region | 2017 Revenue | 17/18

Growth |

| Americas | $635 | 0.6 percent |

| Asia/Pacific | $545 | 3.5 percent |

| EMEA | $492 | 1.1 percent |

| Grand Total | $1,672 | 1.7 percent |

Pay TV services market — Cable, Satellite, Internet protocol (IP), and Digital Terrestrial TV services — will remain flat over the five-year forecast period. These services are an increasingly important part of the multi-play offerings of telecom providers.

Spending on multi-play services is forecast to increase 7 percent in 2018 as compared with 9 percent in 2017.

Spending on fixed voice services will experience CAGR of -6 percent over the forecast period and will represent less than 10 percent of the total market by 2021. Rapidly declining TDM Voice revenues are not being offset by the increase in IP Voice.

“The steady growth in the worldwide telecom market is driven by the need for IP services and higher bandwidth services, which are more than offsetting declining legacy telecom services,” said Courtney Munroe, group vice president, Worldwide Telecommunications Research at IDC.

Kresimir Alic, senior program manager, CEMA Telecoms & Networking, and Worldwide Telecom Services Database, said Mobility is and will dominate the overall telecom market as users in both developing and developed markets increasingly see mobile services based on 3G, 4G and, in the near future, 5G, as a key component of both personal and business communications.

Interestingly, spending on Internet of Things (IoT) is yet to reflect on telecom operators’ revenue streams in a big way.

IDC earlier said worldwide spending on IoT is forecast to reach $772.5 billion in 2018, an increase of 14.6 percent over the $674 billion that will be spent in 2017.

IoT spending will achieve a CAGR of 14.4 percent through the 2017-2021 forecast period surpassing the $1 trillion mark in 2020 and reaching $1.1 trillion in 2021.

Baburajan K