Samsung, Huawei and Apple will lose their smartphone market share in the 5G era, says a Strategy Analytics report on the smartphone industry.

Samsung Electronics has 20 percent share of the global smartphone market as compared with 14.7 percent for Huawei and 13.2 percent for Apple in the third quarter of 2018, research firm IHS Markit earlier said.

Samsung Electronics has 20 percent share of the global smartphone market as compared with 14.7 percent for Huawei and 13.2 percent for Apple in the third quarter of 2018, research firm IHS Markit earlier said.

During the transition from 2G, 3G and 4G, the three phases of the telecommunications world, several phone makers have lost their glory and market share due to design challenges related to innovation.

For instance, Finland-based Nokia peaked in 2G and lost one-third of its market share in 3G and disappeared in the 4G world. Lack of innovation in phone models as well as delay in responding to demands such as dual SIM phones was the main reason for the debacle of Nokia.

Microsoft acquired Nokia’s phone business and assets. Later, Microsoft decided to stop the Nokia business.

Motorola lost four-fifths of its global handset market share in the transition from 2G peak to 3G peak. Lenovo later acquired Motorola phone brand and assets from Google. Lenovo lost some of its phone business recently.

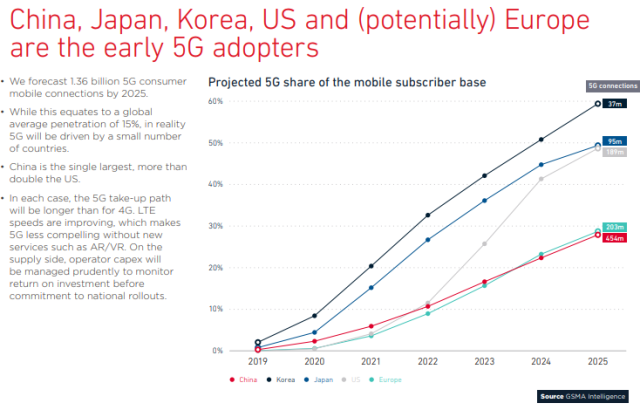

Samsung grabbed opportunity in the transition to 3G and doubled its share. GSMA says China will be one of the key markets for 5G. With a strong presence in China, Samsung will have tough times ahead in the 5G smartphone business.

Chinese vendors burst onto the global stage in 4G with Huawei surging to #2 globally with its fast follower, affordable tech mantra. Since the US has blocked Huawei smartphones and 5G equipment business, Huawei may face challenging times in US.

The 4G era also noticed the emergence of three China-based smartphone vendors such as Xiaomi, Oppo and Vivo.

Who will emerge

Strategy Analytics has identified two main groups of vendors in the fight for 5G: Adaptive Local players and Global Scale Seekers.

Adaptive Local Players including Sharp, ZTE and Sony have consolidated cost basis and a smaller, localized market presence. These vendors need to be more agile in how they market their brands and link features and technology to drive local brand value.

Global Scale Seekers including Xiaomi, Vivo and OPPO expanded their presence beyond local or domestic markets by establishing sales, marketing and distribution resources in enough markets to scale above 80 million units and have established profit centers.

Xiaomi has strong presence in China and India and Europe and will be competing strongly in the Americas.

Smartphone vendors face a complex transition to 5G and to new foldable, rollable designs simultaneously at a time when consumers are increasingly reluctant to spend $800-$1000+ for incremental improvements.

“Competition on the basis of technology advantage will be challenging and inevitably short lived without a healthy portfolio of intellectual property holdings,” said Ken Hyers, director of Emerging Device Technologies, Strategy Analytics.

Smartphone vendors must strive to be global and minimize market specific SKUs where possible, building from a global platform or be local, focused and niche. The profit drain zone is positioned at the bottom of the U-curve with volume between 40 and 60 million where profits are almost impossible to realize.

Lenovo-Motorola, LG, and ZTE, among others, are in perilous positions and must carefully execute a pragmatic 5G strategy or risk surging losses.

Samsung and Huawei each have challenges to maintain growth with 5G due to their limited presence in China and USA respectively.

5G smartphone price

5G smartphones will carry wholesale costs of more than $750 in 2019, translating to retail prices of $1,000 or more. 5G device prices will decline at a much slower pace compared to 3G and 4G handsets. Subsidies will be necessary to make 5G smartphones affordable to the mass market, Strategy Analytics said earlier. 5G devices will be three times more expensive than non-5G handsets in 2025.

5G smartphones will generate $20 billion annually in royalties for intellectual property (IP) holders in 2025, according to Strategy Analytics. Ericsson, Nokia and Qualcomm will take the lion’s share of those royalties.

Baburajan K