The global mobile payment market is set to drive Ontario economy. The government and trade are looking for showcasing its innovation in the mobile payment solutions market to attract companies to support global companies.

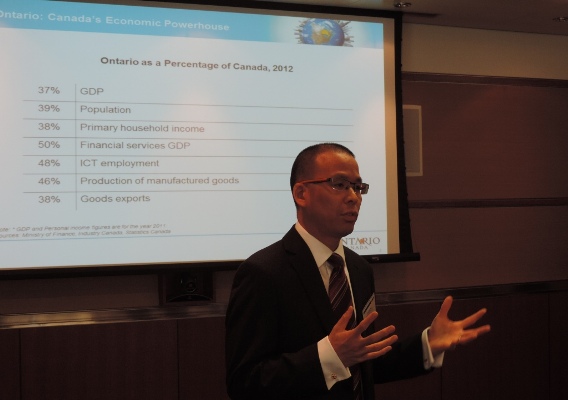

David Wai, senior sector advisor at Ontario Ministry of Economic Development, Trade and Employment, said: “The substantial growth in the Ontario mobile payment market is supported by the presence of global financial companies, strong credit card portfolio, mobile, telecom and IT sectors.”

Around 75 percent of Ontario population uses credit or debit cards. Big 5 banks dominate retail banking. Canada has a very strong payment sector. Cash is a still significant portion. Card payments are also growing, Wai said.

Smartphone penetration is driving the mobile payment market in Canada. Smartphone penetration in Canada is around 62 percent against Spain’s 66 percent and 64 percent in the U.K.

The early adoption of 4G is one of the growth drivers. Early adoption of BlackBerry has contributed to the success. ARPU stands at around $60. For comparison, India’s ARPU is around $3. Three telecom operators Rogers Communications, Bell and Telus – dominate Canadian mobile market. 3G and 4G are focus areas.

Beside technology innovation, cooperation is one of the other focus areas to bring growth.

Innovation in technologies

Ontario has several examples to share.

EnStream, a Bell, TELUS and Rogers joint venture creates a “one-stop” solution for credential issuers and service providers across all mobile devices. EnStream connects card and credential issuers with wireless carriers, allowing consumers to use virtually stored cards, to interact with merchant readers, for payment or identification validation.

CIBC is a North American financial institution with nearly 11 million personal banking and business clients. CIBC offers a range of products and services through its comprehensive electronic banking network, branches and offices across Canada, and has offices in the United States and around the world.

Growth potential

Ontario wants to become the mobile payment technology hub. Its growth will depend on markets such as the U.S.

Market research agency eMarketer says proximity mobile payments will top $1 billion in the US this year. The mobile payment market, according to new figures from eMarketer, will reach an estimated $58 billion by 2017.

Driven by consumers buying items like daily coffee via closed-loop payment systems, as well as an increase in bigger-ticket purchases made via smartphones, mobile payment transactions more than tripled from 2011 to 2012 in the US, reaching $539 million that year, according to eMarketer.

Penetration of NFC-enabled POS terminals is 31 percent in Canada against 27 percent in Japan, 16 percent in the U.S., 12 percent in the U.K., 8 percent in France and 4 percent in Turkey.

Delays and adoption issues facing numerous mobile wallet initiatives, as well as a congested landscape of competing technologies, materially affect eMarketer’s outlook on mobile payment transaction values, which will not top $20 billion until 2016.

The previous forecast predicted mobile payments would top $20 billion by 2015. Additionally, low-value purchases will still comprise the majority of transactions in 2013, causing a dip in the growth rate.

Baburajan K reporting from Ontario

[email protected]