Wireless chip vendor Qualcomm wants to associate with all top smartphone makers and is ready to talk about its contribution and the Snapdragon leadership. Its dominance will continue due to facts such as strong focus, innovation, growth in 3G and 4G and a strong leadership team.

Qualcomm’s record financial performance this year with annual revenues of $25 billion, up 30 percent versus last year, is just an indication of its leadership.

Its wireless chip is associated with smartphones such as Google Nexus 5, LG G2, Motorola Moto X, HTC One, Nokia Lumia 1020, Nokia Lumia 1520, Samsung Galaxy Note 3, Samsung Galaxy S4, Xiaomi Mi3, Sony Xperia Z, Sony Xperia Z Ultra, etc.

Qualcomm also tested waters with tablets such as Sony Xperia Tablet Z, Nexus 7 by Google, LG G Pad, Amazon Kindle Fire HDX, Samsung Galaxy Tab 10.1, Nokia 2520, etc.

Intel, rival of Qualcomm, will be one of the companies to watch out in 2014 in the rapidly growing tablet space.

Raj Talluri, senior vice president of Product Management, Qualcomm CDMA Technologies (QCT), said: “Our technologies underpin the growth of wireless data, and our semiconductor solutions are used across the industry’s flagship smartphones.”

On the other hand, Broadcom, which also supplies processors to smartphone vendors, does not want to emphasize too much about its contribution. Broadcom does not believe in “Intel Inside” theory.

In a recent telecom analysis report, market research agency IHS said Qualcomm closes in on market leaders.

According to IHS, Qualcomm’s success in the wireless world continues to drive it to the top of the semiconductor industry. It is set to attain 31.6 percent semiconductor growth in 2013, causing it to gain 1.2 percentage points of share and take 5.5 percent of total semiconductor market revenue. No. 3-ranked Qualcomm’s strong growth in 2013 will allow it to narrow its market share gap with industry leaders Intel and Samsung.

Transition from chips to smartphone enabler

Qualcomm’s transition from a chip maker to the enabler of smartphones resembles the success of Intel Inside marketing campaigns. The launch of the limited edition Qualcomm Toq smartwatch is one indication. When Samsung Galaxy Gear smartwatch received significant criticism, Qualcomm could withstand market expectation.

The transition is putting Qualcomm well ahead of competition. That’s why Qualcomm is expected to support the strong growth of 3G and 3G/4G multimode devices around the world, particularly in China with the anticipated launch of LTE. China Mobile will launch 4G on 18 December.

Qualcomm is currently facing probe for allegedly fixing 4G chip prices in China. This could have an impact on Qualcomm’s sales in the world’s largest telecom market.

Before the price fixing probe came into light, Qualcomm said it remains well positioned from a growth standpoint, and it expects double-digit compound annual growth rates for both revenues and earnings per share over the next five years. So far, Qualcomm has not given a revised update.

Qualcomm and innovation

Recently, Qualcomm announced Snapdragon 410 that will enable smartphone makers to bring out below $150 smartphones for 4G markets.

Snapdragon 410 is the finest example of innovation. Driving integrated 4G LTE across entry-level tiers, Snapdragon 410 is 32-bit and 64-Bit capable and designed for high-volume smartphones and tablets.

Raj Talluri of Qualcomm says the new chip is purpose-built for China.

In yet another example for Qualcomm leadership, the new Qualcomm Snapdragon 805 ultra HD mobile processor comes with first Ultra HD (4k) display & UI; first Ultra HD gaming with Adreno 420 GPU; first Ultra HD HEVC (h.265) hardware video decoder; first Gigapixel per second camera ISP and first 2×64-bit POP memory for fast, seamless multitasking.

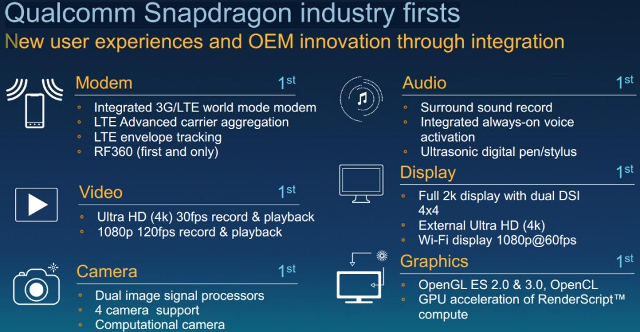

Qualcomm Snapdragon, which is setting new benchmarks for the mobile phone industry, has many firsts.

IHS says the wireless segment will drive the largest increase in semiconductor consumption of chips in 2013. Semiconductor revenue from wireless communications products are projected to grow by 11.7 percent in 2013.

Semiconductor revenues driven by consumer electronics products will decline, with a drop of 5.2 percent.

Asia-Pacific will lead all regions in terms of consumption of semiconductors with growth of 8.9 percent in 2013. The Americas will not be far behind with a 5.0 percent increase. Japan will experience a decline of 7.9 percent.

Qualcomm leadership will stabilize because of the growth of 3G and 4G market driven by demand for mobile broadband. Plus, its rivals are less active.

Baburajan K

[email protected]