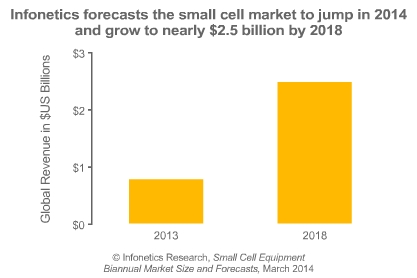

Telecom analysts are predicting substantial demand for small cell deployments because mobile users want better experience when they make phone calls or access data.

Interestingly, no telecom operator in the world is ready to share their specific small cell deployment strategy and investment plan. Most of these telecom operators are in the process of piloting or in initial stages of small cell deployments.

Telecom network vendor Ericsson has already shipped hundreds of thousands of small cells and carrier Wi-Fi access points to leading operators around the world. The company says several telecoms are already deploying small cells.

Ericsson also recently launched RBS 6402, the first indoor picocell to deliver 300 Mbps LTE speeds with carrier aggregation.

Telecom operator Swisscom says its focus is to better customer experience by adding cost-effective offerings for smaller buildings.

Patrick Weibel, responsible for Mobile Data Networks, Swisscom, said: “With the small cell RBS 6402 from Ericsson we can reduce our costs without compromising performance.”

Nokia Networks, as part of expanding small cell portfolio, announced small cell base station Flexi Zone G2 Pico, and an indoor planning service enhanced by 3-D geolocation.

By 2020, almost 78 percent of mobile traffic will be handled by small cells, said Signals Research Group.

“Starting predominantly in North America and Asia Pacific, we are seeing small cell deployments growing in Western Europe, albeit mostly at the planning stage today. We expect to see Latin America follow this pattern over the next couple of years,” said Sanjay Sharma, regional vice president and head for South West Asia Region at Amdocs.

DAS rivals small cells

ABI Research finds that there is a competition between Distributed Antenna Systems (DAS) and small cell vendors for coverage and capacity in the $8.5 billion enterprise in-building wireless systems market.

DAS systems challenge small cells by building on their inherent advantages of neutral host, and macrocell parity and adding features such as traffic steering and multiple network convergence on the same in-building backhaul. They also challenge small cells by tackling one of the main drawbacks: cost per sq. foot of installation and Opex needed for system cooling and operation.

Small cells do not provide a neutral host capability and are complex to configure and virtualize since the baseband, unlike DAS, is distributed in each small cell which must coordinate with its neighbor to mitigate interference, says ABI Research.

Tips for telecom CTOs before selecting small cells

Consider your public access small cell deployment strategy carefully and who would be the supplier/provider of the service.

Select a business model which offers the best ROI for the medium and long term.

Partnering will be key to successful small cell deployments and service delivery and can include NEPs, Backhaul service providers, Infrastructure and street asset/site owners, other service providers offering Small Cells as a Service, Tower Build companies, ISVs and Professional Services organizations.

Look at your planning and deployment tools and processes and be prepared to upgrade using the latest workflow solutions designed for small cell deployment – especially when planning high volume deployments of small cells (more than 10k sites).

Be prepared to make some organizational changes to accommodate the new model and process.

No significant uptake for small cells

Dell’Oro Group says fiber and LTE coverage build-outs will continue to drive telecom equipment investments in 2H14 and 2015. The proportion of Capex that will be allocated to new technology enablers and network topologies including NFV and small cells is expected to be negligible over the next six quarters.

“Multiple factors will contribute to a decline in telecom Capex during 2015,” said Stefan Pongratz, Dell’Oro Group’s Carrier Economics analyst.

Higher device penetration, decelerating mobile data growth rates, lack of new revenue streams, and increased competition in both the developing and developed markets have caused worldwide revenue growth to decelerate in the last couple of years.

Analog Devices, which generates more than 20 percent of the $2.7 billion revenue from telecom infrastructure, sees the rapid shift to LTE where the value content of Analog Devices components is significantly more compared to in the 2G and 3G era.

Early small cell adopters

“With the shift towards smaller base stations, Analog Devices dedicated a range of single chip wide band transceivers that integrate most of the components in transmit and receive chain into one single semiconductor chip. This enormously reduces the footprint of a small cell, makes it an order of magnitude less power hungry and reduction in cost,” said Somshubhro Pal Choudhury, MD, Analog Devices India.

“With more than 7 billion connected devices by 2017 and monthly mobile data traffic of more than 15 exabytes telecom network congestion is a given and small cells will play a big role in mitigating the congestion at the same time making sure of ubiquitous network coverage,” Choudhury added.

While small cell deployment is going to be ubiquitous in the coming years, some of the early adopters have already started deployment. The US telecom providers like Verizon, for example, started small-cell roll out in February to deliver higher capacity and coverage. AT&T has also been deploying Femto gateways for last several years.

LTE deployment will increase the proliferation of small cells especially where deployments are happening at higher frequencies which implies denser network. The way it would pan out is macro LTE base stations deployed first and small cells getting deployed in areas of coverage and high traffic and indoor spaces. This would usually happen post the macro deployment.

ABI Research expects operators like AT&T, Verizon, Vodafone, Telefonica, Softbank, SK Telecom, and Sprint to drive the growth by deploying both outdoor small cell and metrocell networks.

In 2015, 4G small cells will be the fastest growing small cell type in the market driven by venue and dense urban deployments.

ABI Research forecasts the number of LTE small cells to double in 2015 and by a similar factor each year through 2019 where the value of LTE small cells will represent almost 70 percent of the small cell equipment market.

Baburajan K

[email protected]