IHS Markit | Technology has revealed 5G smartphone forecast for 2019 and 2020.

A total of 13.5 million 5G smartphones are forecast to be shipped in 2019, according to the Smartphone Model Market Tracker. 5G smartphone demand in 2020 is expected to reach 253 million units.

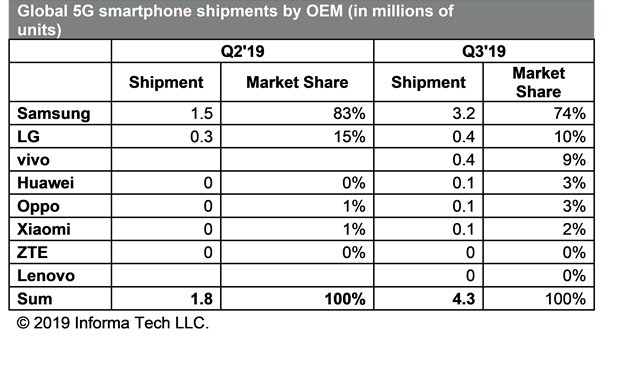

Samsung has dominated the global 5G smartphone market, accounting for three-quarters of shipments in Q3 2019.

Samsung shipped 3.2 million 5G smartphones during the third quarter of 2019, grabbing 74 percent of the 4.3 million unit global market for 5G smartphones.

Samsung’s 5G smartphone shipments in the third quarter more than doubled compared to 1.5 million units in the second quarter. Samsung held 83 percent share in the second quarter of the year.

LG Electronics is in the second position with 10 percent share. Vivo has 9 percent share in the global 5G smartphone market. Huawei and Oppo have 3 percent share each in the 5G smartphone business.

“The company capitalized on its home-field advantage in the South Korean market to ramp up shipments. Samsung also has moved quickly to fill out its 5G smartphone line, giving it the largest portfolio of any brand,” said Gerrit Schneemann, senior analyst, smartphones, at IHS Markit | Technology.

Both Samsung and LG have offered aggressive promotions in South Korea, allowing them to quickly claim the top market-share positions.

The development of the South Korean market contributed to the growth in 5G shipments, which more than doubled between the second and third quarters.

Samsung currently has five 5G smartphone models in the market. The Galaxy Note 10 Plus 5G was the leading 5G model in the third quarter, shipping 1.6 million units, according to the Smartphone Model Market Tracker from IHS Markit | Technology.

“Samsung is integrating 5G connectivity in a broad range of devices, from the Galaxy A90 to the Galaxy Fold 5G,” said Jusy Hong, smartphone research and analysis director at IHS Markit | Technology.

LG’s cumulative second- and third-quarter 5G smartphone shipments reached 700,000 units. Shipments from Chinese OEMs Xiaomi, Huawei, Lenovo, vivo, OPPO and ZTE, represented 17 percent of total 5G shipments with 700,000 units in the second and third quarters.

Though Chinese OEMs account for more than half of the smartphone market, their share of 5G smartphone shipments totaled only 17 percent in the third quarter. This small share is due to the fact Chinese-made 5G models mostly shipped to overseas markets, where the majority of smartphones these OEMs sell are mid-range and low-end devices.

All 5G phones shipped in 2019 are powered by the latest high-end chipsets and follow the premium specification, which requires premium pricing. The report did not mention about the dominance of Qualcomm in the 5G smartphone business.

5G smartphone price

The average price of 5G smartphones in the second quarter was $1,153. Prices dipped slightly in the third quarter, falling to $994. The pricing range is becoming more diverse, with some OEMs targeting high-end prices around $600 for their 5G phones, while flagship devices like the Galaxy Fold push pricing ever higher.

The average 5G smartphone price was more than three times higher than the average smartphone price of $309 during the third quarter.