Apple is slashing the manufacturing of its three new iPhone models by about 10 percent for the January-February-March quarter, the Nikkei Asian Review reported.

Apple iPhone suppliers will be cutting the production volume of both old and new iPhones to about 40 million to 43 million units for the January-March quarter, from an earlier projection of 47 million to 48 million units.

Apple iPhone suppliers will be cutting the production volume of both old and new iPhones to about 40 million to 43 million units for the January-March quarter, from an earlier projection of 47 million to 48 million units.

Apple asked its suppliers late last month to produce fewer-than-planned models of the XS, XS Max and XR. Apple, the third largest smartphone maker, made the request before Apple cut its revenue forecast for December quarter last week.

Apple on last Wednesday had lowered its revenue forecast to $84 billion for its fiscal first quarter ended December 29 against the original forecast revenue of between $89 billion and $93 billion.

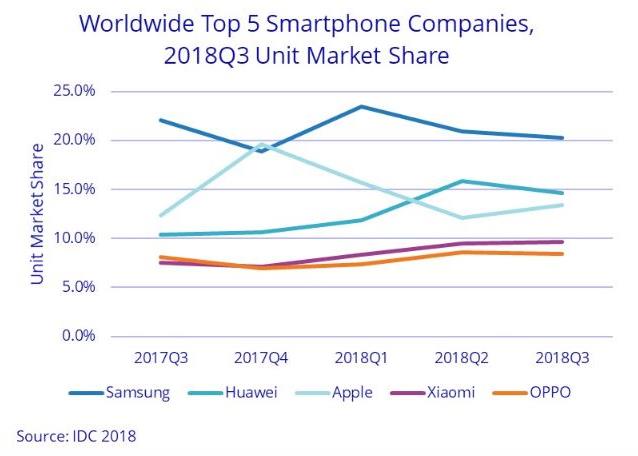

Huawei earlier said it shipped 200 million units of smartphones in 2018. Samsung said it will report a significant reduction in both revenue and profit in Q4 2018.

The latest development indicates that Apple iPhones are not generating enough demand in several markets specifically in China due to a slowing economy. China is the home market for Huawei, Xiaomi and OPPO.

The latest development indicates that Apple iPhones are not generating enough demand in several markets specifically in China due to a slowing economy. China is the home market for Huawei, Xiaomi and OPPO.

“In fact, most of our revenue shortfall to our guidance, and over 100 per cent of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad,” Tim Cook said in a letter to investors on January 2.

Wednesday was the first time that Apple issued a warning on its revenue guidance ahead of releasing quarterly results since the iPhone was launched in 2007.

The Cupertino, California-based company in November said it would quit disclosing unit sales data for iPhones and other hardware items, leading many analysts to worry that a drop in iPhone sales was coming.

Several iPhone component makers in November forecast weaker-than-expected sales, some market watchers called the peak for iPhones in several key markets.

Tim Cook in November cited slowing growth in emerging markets such as Brazil, India and Russia for a lower-than-anticipated sales estimates for the company’s fiscal first quarter. But Cook specifically said he would not put China in that category of countries with troubled growth.

In the latest fiscal year, ended September 29, unit sales of the iPhone were essentially flat from the prior year, while iPhone revenue expanded 18 percent to $166.7 billion. That growth came entirely from higher prices.