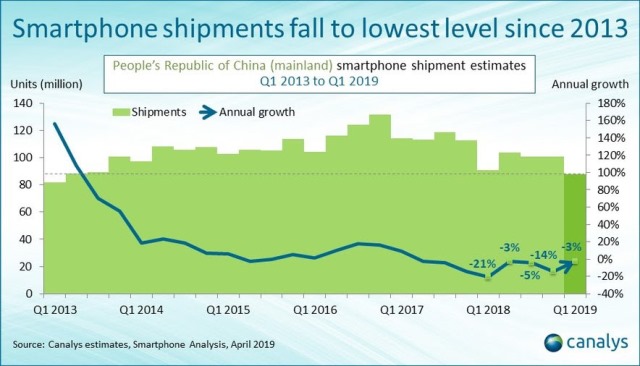

China’s smartphone market dropped 3 percent to 88 million in Q1 2019, making it the worst performance in six years, according to research firm Canalys.

Huawei grew its share to 34 percent, making it the only phone vendor in the top five to report growth in an otherwise declining smartphone market in China.

Huawei grew its share to 34 percent, making it the only phone vendor in the top five to report growth in an otherwise declining smartphone market in China.

Huawei (including Honor) shipped just under 30 million smartphones. Oppo, Vivo, Xiaomi and Apple suffered year-on-year declines.

Canalys Analyst Mo Jia said: “Huawei increased investments in bricks-and-mortar stores to exploit its size and out-compete smaller vendors. It has penetrated further into China’s rural areas.”

Oppo and Vivo are both shifting their product strategies to refresh their brands, said Canalys Research Analyst Yiting Guan.

Oppo has presented its RealMe business, which is successful in India, in China to compete at the low end with Xiaomi and Huawei, including Honor.

Oppo has presented its RealMe business, which is successful in India, in China to compete at the low end with Xiaomi and Huawei, including Honor.

Xiaomi posted year-on-year decline in both shipments and market share.

Apple shipped 6.5 million iPhones, suffering its worst decline in two years. Apple has cut the iPhone retail prices, which has largely relieved the pressure from its channel partners.

Despite the iPhone’s installed base in China being well over 300 million, it is vital that Apple prevents users deserting it for Android vendors. Apple faces a challenge in China to localize its software and services offerings as quickly as in Western markets.