Apple iPhone assembler Foxconn Technology reported 17.03 percent year-on-year increase in revenue to 1.07 trillion New Taiwan dollars or $34.8 billion last quarter.

Foxconn said its net profit dropped 2.18 percent on the year and 27.37 percent on the quarter to NT$17.49 billion. The net profit was Foxconn’s lowest since the third quarter of 2013.

Foxconn said its net profit dropped 2.18 percent on the year and 27.37 percent on the quarter to NT$17.49 billion. The net profit was Foxconn’s lowest since the third quarter of 2013.

Gross margin of Foxconn fell 1.18 percentage points on the year to 5.63 percent. Operating margin slid 1.25 points to 1.46 percent. Foxconn’s gross margin was its lowest since second-quarter 2012, while operating margin hit its weakest since the first quarter of that year.

The iPhone assembler’s net profit fell 9.72 percent to NT$41.57 billion for the first half of 2018 from NT$46.04 billion in the year-ago period.

Foxconn declined to comment on its earnings performance.

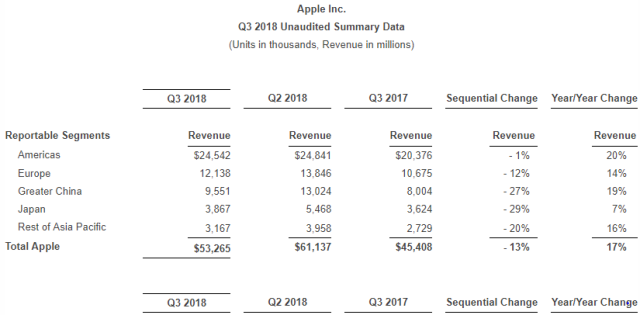

Apple, which accounted for some 50 percent of Foxconn’s revenue, reported record April-June revenue and profit on July 31, driven mainly by growth from services, AirPods and Apple Watch accessories.

Apple, which accounted for some 50 percent of Foxconn’s revenue, reported record April-June revenue and profit on July 31, driven mainly by growth from services, AirPods and Apple Watch accessories.

Shipments of iPhones, which are closely correlated with earnings at Foxconn and smaller rivals Pegatronand Wistron, grew only 1 percent on the year.

Foxconn’s earnings reflect rising costs for components, labor recruitment expenses in China and the burden from Hong Kong-listed subsidiary FIH Mobile’s expanding loss. FIH Mobile said that its first-half net loss widened to $348.06 million from $196.9 million a year ago.

Foxconn’s $10 billion investment in a Wisconsin factory project that broke ground on June 28 also may be weighing on operating expenses, which rose more than 18 percent year-on-year to NT$44.95 billion last quarter.

Apple is asking suppliers to prepare 20 percent fewer components for new iPhones than a year ago. The U.S. tech company will monitor market reaction for the new phones before deciding whether to add more orders.

Nikkei reported that Apple intends to introduce three iPhones this year: an expensive model featuring a 6.5-inch organic light-emitting diode display, one equipped with a 5.8-inch OLED screen and a lower-priced model offering a 6.1-inch liquid crystal display screen.

Foxconn remains the largest iPhone assembler this year. It secures 100 percent of the orders for the 5.8-inch OLED iPhones, as well as an 80 percent to 90 percent share of the 6.5-inch OLED phones. The company holds a 30 percent order allocation for the 6.1-inch LCD model, according to Yuanta Investment Consulting’s supply chain checks.

Pegatron takes the majority of the remaining orders, while Wistron will not begin production for the 6.1-inch LCD iPhones until the end of this year.

Foxconn posted a net profit of T$17.49 billion or $567.25 million for the quarter ended June versus T$17.9 billion a year ago.

They come on the heels of a wider first-half loss at Foxconn unit FIH Mobile amid bleak demand from smartphone vendors. FIH acknowledged it faced a high risk of saturation in the smartphone market.

Apple sold half a million less-than-expected iPhones in the fiscal third quarter ended June, but robust sales of costlier models like the $999 iPhone X helped push its results far beyond Wall Street targets for the period, Reuters reported.