Huawei, hit by U.S. sanctions, may face 9-24 percent drop in its smartphone share this year, according to Fubon Research and Strategy Analytics.

China-based Huawei also faces the possibility that its smartphones will disappear from several international markets.

Huawei’s smartphone shipments are likely to slide over the next six months due to uncertainties surrounding the ban.

The U.S. Commerce Department blocked Huawei from buying U.S. components last week amid its escalating trade spat with China. This means, Microsoft, Intel, Qualcomm, Google, among others, cannot sell components to Huawei.

The ban applies to goods and services with 25 percent or more of U.S.-originated technology or materials, and may, therefore, affect non-American firms.

“Huawei may be wiped out of the Western European smartphone market next year if it loses access to Google,” said Linda Sui, director of wireless smartphone strategies at Strategy Analytics.

Linda Sui predicts Huawei handset shipments will decline another 23 percent next year but believes the company could survive on the sheer size of the China market.

Fubon Research, which previously forecast Huawei would ship 258 million smartphones in 2019, now expects the company to ship just 200 million in a worst-case scenario.

Fubon Research, which previously forecast Huawei would ship 258 million smartphones in 2019, now expects the company to ship just 200 million in a worst-case scenario.

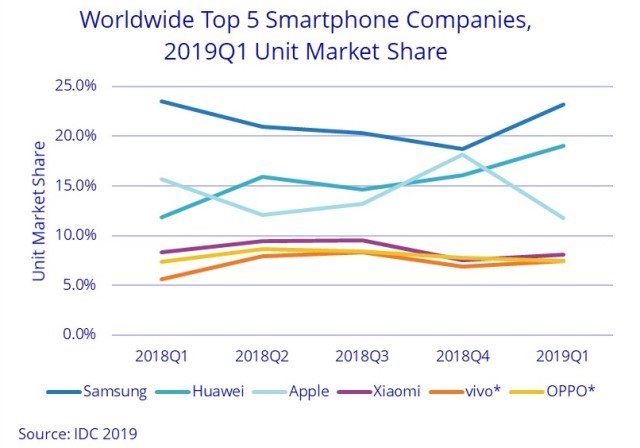

Earlier IDC report said Huawei has nearly 19 percent of the global smartphone market in Q1 2019. Huawei has shipped 59.1 million smartphones during the first quarter of 2019 grabbing second position.

The company counts Europe as the most important market for its premium smartphones. In Europe, approximately three-quarters of smartphone users rely on an Android-based phone. Huawei accounts roughly for 20 percent of this market.

“Such reckless decisions can cause a great deal of harm to consumers and businesses in Europe,” Huawei Deputy Chairman Ken Hu said at the Potsdam Conference on National Cybersecurity.

Huawei has said it has been developing the technology it needs to be self-sufficient for years.

But experts are not buying the company’s claim, Reuters reported. They said components and intellectual property needed in Huawei’s devices are not available outside the United States.

Huawei may potentially need to lay off thousands of people and disappear as a global player for some time, said Stewart Randall, who tracks the chip industry at Shanghai-based consultancy Intralink.

Potential buyers of Huawei’s phones are likely to switch to high-end devices from Samsung Electronics and Apple, and also buy mid-end phones from domestic rivals OPPO and Vivo, analysts said.

“It leaves an amount of share in its wake that can get picked up by competitors, particularly Samsung given its strength in regions like Europe,” said Bryan Ma, who researches the global smartphone market at IDC.

Huawei handsets are already drawing fewer clicks from online shoppers since the United States blacklisted the company, according to PriceSpy, a product comparison site that attracts an average of 14 million visitors per month.