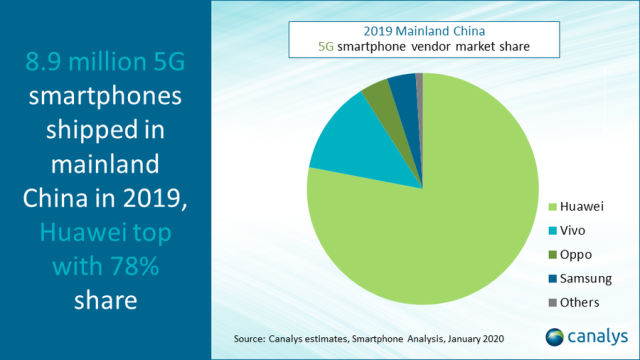

The size of 5G smartphone market in China was 8.9 million units in 2019 and the leader was Huawei.

China’s Huawei has grabbed 78 percent share in the Chinese 5G smartphone business. Vivo, Oppo and Samsung are the other leading 5G smartphone suppliers in China during the last year. All three telecom operators started offering 5G services in China last year.

China’s Huawei has grabbed 78 percent share in the Chinese 5G smartphone business. Vivo, Oppo and Samsung are the other leading 5G smartphone suppliers in China during the last year. All three telecom operators started offering 5G services in China last year.

“With the rollout of 5G and more incentives given by operators this year, 5G smartphones are expected to exceed 150 million units in 2020,” Nicole Peng, Canalys’ VP Mobility, said.

The overall market faces high pressure to downsize with the black swan event of the outbreak of coronavirus. This will have a significant and long-lasting adverse effect on the country’s tech manufacturing industry, retail sector and consumer consumption.

China’s smartphone market fell 15 percent to 85.3 million units in Q4 2019, as device fatigue hit consumers. It marks the 11th consecutive quarterly decline, and the market’s lowest level since Q1 2013.

For the 2019 full year, China’s market closed at 369 million units, down 7 percent year-on-year. The market significantly underperformed in a traditionally high season of smartphone sales, given a drastic slowdown of 4G smartphone purchases coupled with weaker demand than major vendors’ anticipated for 5G smartphones.

Huawei maintained the lead in China with 39 percent market share by growing 11 percent over Q4 2018, despite a sharp sequential decline of 20 percent.

Oppo and Vivo remained in second and third place, although both shipments fell faster than market average at 25 percent and 29 percent. Apple moved up one position to number four and Xiaomi rounded the top five in Q4.

Huawei shipped more than 33 million smartphones in China in Q4. Huawei will find it challenging to persuade smartphone distribution partners to increase wallet share of Huawei’s devices in 2020.

“Despite Huawei leading the 5G smartphone shipments with a 78 percent share, the vendor must help channel partners ease the 4G device inventory pressure before more 5G devices flood the market,” said Nicole Peng, Canalys’ VP Mobility.

Apple reversed its decline with a China smartphone Q4 market share of 11.8 percent, the vendor’s highest in eight quarters.

Apple narrowed its decline to 12 percent with 10 million iPhones shipped. The pricing of the iPhone 11 was a big contributor to Apple’s Q4 result.