Apple supplier LG Display said its revenues dropped 8 percent to KRW 6,422 billion in the fourth quarter of 2019.

LG Display reported operating loss of KRW 422 billion. This compares with the operating loss of KRW 436 billion in the third quarter of 2019 and the operating profit of KRW 279 billion in the fourth quarter of 2018.

EBITDA of LG Display in the fourth quarter of 2019 was KRW 586 billion, compared with EBITDA of KRW 613 billion in the third quarter of 2019 and with EBITDA of KRW 1,134 billion in the fourth quarter of 2018.

LG Display posted net loss of KRW 1,817 billion in Q4, compared with the net loss of KRW 442 billion in the third quarter of 2019 and the net income of KRW 153 billion in the fourth quarter of 2018.

The revenue increase of 10 percent quarter-on-quarter was driven by a rise in sales of large-size OLED panels for TVs and P-OLED (Plastic OLED) panels for smartphones which also resulted in an 18 percent increase of ASP (Average Sales Prices) compared to the previous quarter.

LG Display achieved a rise in P-OLED shipments, as it secured a sound base for strategic customers for P-OLED in the fourth quarter. The company’s operating loss improvement on a quarter-on-quarter basis was limited due to an increase in fixed costs for full-scale P-OLED mass-production and additional costs for the company’s move towards structural innovation for its LCD business.

The net loss was mainly due to the withdrawal from the OLED Lighting business and KRW 1.4 trillion won due to the unfavorable circumstances for P-OLED business.

Panels for TVs accounted for 28 percent of the revenue, 4 percent down from the previous quarter due to sales decline in commodity LCD TV panels which resulted from its efforts towards structural innovation in the LCD business.

Panels for mobile devices accounted for 36 percent, an 8 percent quarter-on-quarter increase, driven by the shipment increase of P-OLED panels for smartphones, while those for tablets and notebook PCs accounted for 20 percent and desktop monitors for 16 percent respectively, LG Display said.

“We will make efforts to achieve a significant revenue increase in large-size OLED panels as our OLED plant in China will ramp up production, and continue to stably manage forecasts for P-OLED panels for smartphones as well as for automobiles,” Dong-hee Suh, CFO of LG Display, said.

LG Display offered an optimistic outlook for the year on higher demand for its organic light-emitting diode (OLED) panels. The forecast comes after a rough year for the South Korean company that saw a prolonged decline in liquid crystal display (LCD) panel prices, a management shake-up, and costs from restructuring and strategy changes, Reuters reported.

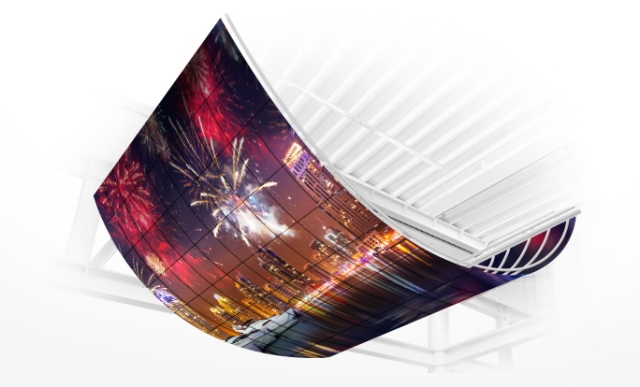

The company has said it will halt domestic production of LCD TV panels by the end of the year and is now investing heavily in OLED displays that are generally thinner and allow more flexibility in device design than LCDs.

The company, which recently became a plastic-OLED display vendor for Apple’s latest iPhones, has said it expects to kick off mass production at its China OLED factory some time in the March quarter.

LG Display has not yet closed its Chinese factories since the outbreak of a new coronavirus. The company said the matter increased uncertainty on the LCD supply side.

LCD panel prices have dropped in two-and-a-half years in a market crowded with Chinese makers. The glut has forced LG Display and rival Samsung Display – a unit of Samsung Electronics – to cut output.

Prices have risen slightly since late December, but on Thursday, Samsung Electronics said it nevertheless expected the business to remain weak in 2020.