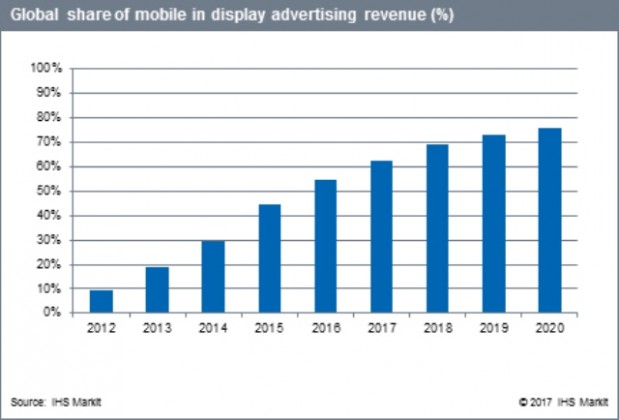

Mobile advertising is gaining further momentum globally. China will drive the growth in mobile advertising revenue. More than three-quarters of all online display advertising revenue will come from mobile by 2020, according to IHS Markit.

ALSO READ: Live news from Mobile World Congress 2017

Mobile display advertising has achieved 72 percent growth in 2015 – accounting for 45 percent of all online display advertising revenue, with a total of €29 billion.

Mobile advertising will grow 42 percent to $41 billion in 2016 — and for the first time will generate 55 percent of all online display advertising revenue.

“Mobile advertising has grown stronger than any other medium in the last four years, and now accounts for a significant proportion of online advertising revenue,” said Qingzhen Chen, senior analyst at IHS Markit.

With roughly $33 billion in revenue for 2016, the Chinese online advertising market is the second largest in the world.

Online grew 17.5 percent in 2016 thanks to 51 percent increase in online video.

Online is expected to grow 14 percent in 2017 driven by 32 percent growth in online video.

China’s online advertising regulations reduced online advertising revenue. But the same regulation will bolster a more sustainable online ad ecosystem in the long term.

TV has entered a third year of consecutive decline with a single-digit contraction. Many people are switching to online for content consumption and seeking wider range of content, from foreign content to user-generated content by popular vloggers. TV in China declined 2.7 percent in 2016, and IHS Markit expects a 3 percent drop in 2017.

Baidu, Alibaba and Tencent own 36.5 percent of the total ad market with a total of CNY 160 billion or $24 billion in 2016. Baidu, Alibaba and Tencent has absorbed large TV brand budgets and online ad budgets, and continues to expand aggressively into digital.

Baidu, Alibaba and Tencent made 262 investments, 27 acquisitions and one joint venture between 2009 and 2016. Mobile app companies received most investments from these three companies during the period.